The sixth largest foundry in the world, Powerchip Semiconductor Manufacturing Corporation (PSMC), plans to go public on the Taiwanese stock exchange in December. After financial difficulties around a decade ago with high debts and restructuring measures, the foundry looks to a bright future.

After DRAM almost written off, now back to life

Powerchip has been around as a chip manufacturer for 27 years, they started in the DRAM market. Together with Elpida they were doing well at the beginning of the new decade and were planning massive expansions such as five new factories.

The big financial crisis in the DRAM sector from 2008 onwards almost completely ruined the plans, Powerchip was taken off the stock exchange and completely reorganized itself in the following years, the DRAM business went to Elpida in 2011, which is now part of Micron . Powerchip then continued the change to a pure foundry, which was only completed in 2019 when it was named Powerchip Semiconductor Manufacturing Corp (PSMC). Now the company is to be brought back on the stock exchange.

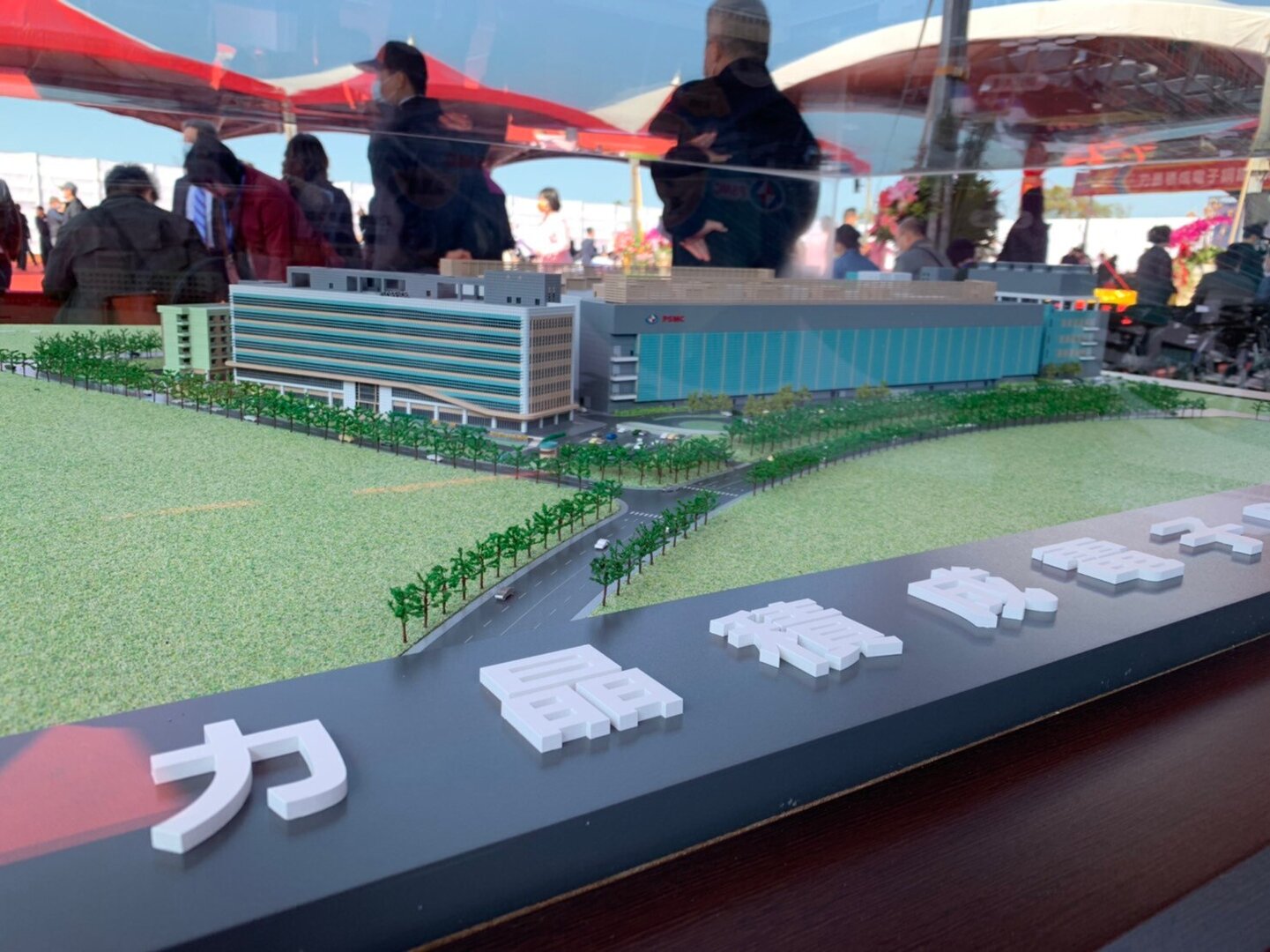

The latest figures speak for themselves and for PSMC. Sales grew steadily this year, in September it was 52 percent above the previous year and thus outperformed the foundry giants TSMC and UMC, which are also based in Taiwan, in terms of percentage growth. Rising prices also increase the margin, and the high demand for chips is paying off. In March of this year, the foundry therefore laid the cornerstone for a new 300 mm wafer plant, with almost 10 billion US dollars to be invested there. With 100,000 wafer starts per month from 2023, the new plant is in no way inferior to TSMC's Gigafabs.

But Powerchip does not manufacture the very smallest high-end chips, but primarily wants to be in the field of classic ICs for power supply, microcontrollers, MOSFETS, but also image sensors, components for DRAM and flash memories and parts claim for the markets of the future around topics 5G, artificial intelligence, automotive and more. For this purpose, products are currently being produced in two 200 mm wafer factories and three 300 mm factories in various production stages from 350 to 28 nm and with the new fab also the first processes in 1x nm.

The Taiwanese authorities have now cleared the way so that nothing stands in the way of the IPO at the end of the year. This would be the second in a short time, because the almost direct competitor Globalfoundries will also go public in the next few months.