Samsung is also feeling the headwind in the chip business, but the huge conglomerate is benefiting from sales in other sectors. However, these can use the winning machine DRAM & Co by no means compensate, so the decline in this area is clear.

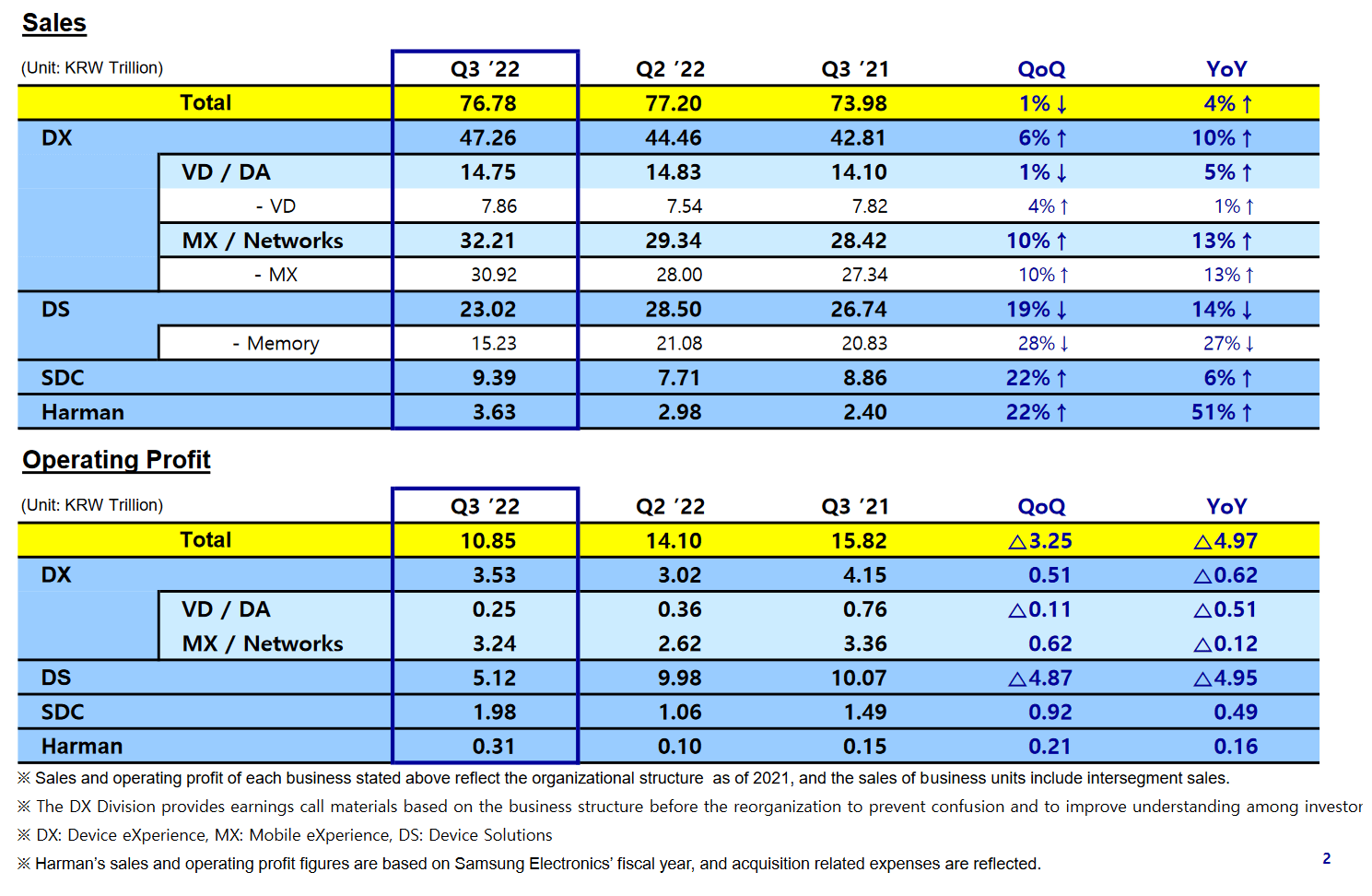

Extracting the exact figures from Samsung's quarterly report is not an easy task, since the group likes to disclose them only in part or incompletely. The DS division, Device Solutions, includes the business with DRAM and NAND, but also the system LSI business and the foundry division. That makes it difficult to quantify the problem areas exactly, even though the memory business is the largest item. That's why Samsung breaks down this area at least in part, but again only in terms of sales.

And that's where the greatest decline is already evident in sales, a minus of 27 percent compared to the previous year in the memory division. The whole division, in turn, made only 14 percent less sales. Nevertheless, the entire DS division posted a 49 percent decline in profit, it de facto halved in the operating business, and thus also pulls the overall profit of the group down significantly – because this division is undoubtedly the best horse in the stable for Samsung in terms of profits to achieve.

Samsung is also shifting down a gear

However, the decline in sales at Samsung was offset by all other areas, so that in the end there was even a slight plus here. However, the uncertainties in many areas will prevail for the near future, although Samsung appears with almost exclusively positive news in the quarterly report and does not want to know anything about major cuts.

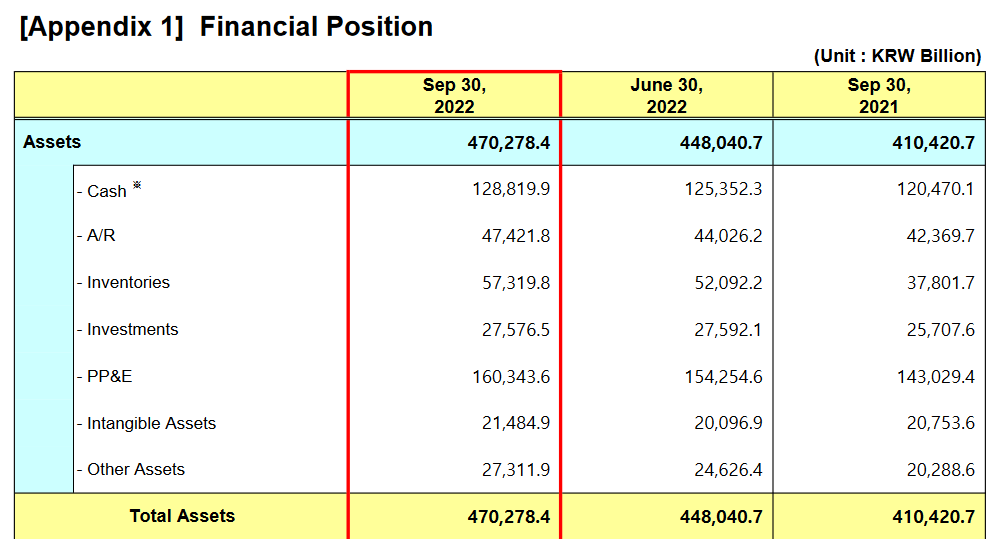

Nevertheless, it is already clear that from the planned CAPEX this year of almost 48 trillion won, Samsung has spent 29 trillion won in nine months, that the target here in the last reached within three months seems questionable. To put it diplomatically, it says for the storage division, for example: “The company plans to align its supply strategy with the mid-term market outlook, taking into account the limited overall production in the industry.”. The bottom line is that due to the current massive oversupply of the market, falling prices and high inventory levels at customers, Samsung is likely to cut production and spending as well. Samsung does not see an upswing again until the second half of 2023.

Inventory levels continue to rise at Samsung too (image: Samsung)

Inventory levels continue to rise at Samsung too (image: Samsung)