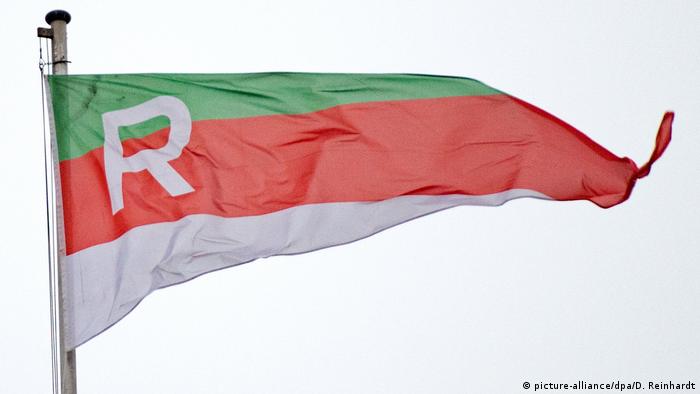

The ship’s crisis calls for your next victim: the rich tradition of The Hamburg-based shipping company Rickmers is broke. The largest lender, HSH Nordbank, turned the money faucet and rejects a restructuring concept.

The Executive Board is striving for rehabilitation in self – administration under a continuation of the business and operation of ships, as he announced on Wednesday evening. More than 2000 employees fear for their Jobs. The shipping company, whose roots reach back to the year 1834, recorded a loss of EUR 341 million and had liabilities in the amount of approximately 1.5 billion euros.

Rickmers, most recently with 114 ships in operation, is the second major Bust since the South Korean container shipping company Hanjin last fall. “There’s a Domino stone falls back now,” says Thomas Wybierek, shipping analyst with NordLB. The shipping is in the ninth year of the crisis. You make Overcapacity and falling freight prices.

The editorial recommends

At the end of the shipping crisis, ahoy?

Container giants around Bob blank: For the past nine years, the shipping companies have to fight against Bankruptcy. The rudder around new cargo alliances to tear now, but the call the next Trouble on the Plan. (31.03.2017)

Shipping crisis is costing Jobs in Germany

World’s ship-builders and ship-owners through difficult times. This is now also available in Hamburg and Bremerhaven noticeable. There are two shipyards to dismiss around a third of its workforce. (28.02.2017)

The rear waves of Hanjin

The international shipping crisis, calls for a first great sacrifice: The South Korean shipping company Hanjin. Ships no longer call at ports that Were not deleted. This could also meet German shipowners. (12.09.2016)

Small ships asked little

Rickmers rented as Charter shipping vessels to major container lines as the global market leader Maersk of Denmark, CMA CMG from France, and MSC, based in Switzerland, and Yang Ming from Taiwan. These ever larger container ships and close to Alliance, in order to reduce costs. Smaller shipping companies, such as Rickmers have the Look. Their often smaller ships are less in demand. “We see the Charter market under more pressure,” says Wybierek. He considers it possible that other shipping companies run out of air.

Rickmers had wanted to avert the threat of a reorganization plan. To the rescue of the company and is now the sole owner Bertram Rickmers was ready, the majority of the bond holders and banks to make and hold less than 25 percent. He also wanted to shoot a 20 million Euro from your own pocket and millions more for the emergency.

“Renovation concept is not viable”

For the shipping company, the rejection came by HSH Nordbank out of the blue. The Bank had communicated its decision “very surprising and without any further negotiation”. The HSH had repeatedly stressed that the restructuring plan was not subject to the approval by the Board of Directors. “The HSH Board of Directors has examined the Rickmers-renovation concept carefully and considers it as economically not viable,” said a Bank spokesman.

The ailing HSH fighting, once the world’s largest provider of Ship Finance with the consequences of the crisis in the sector. On the question of whether the Bank should increase due to the Rickmers-Broke, risk prevention, said the spokesman, HSH was prepared for the Situation. He pointed out that the Institute had increased the Provision for non-performing loans in the shipping industry alone 2016 to around two billion euros.

Meeting of creditors obsolete

Actually, should vote this Thursday, the creditors of a 275-million-Euro bond issue at a meeting on the reorganization plan, which provided for them a renunciation of their claims. The vote on the renovation plan is a waste of time. The bondholders are now to choose at the Meeting, only a common representative.

Rickmers had grown a few years ago strong and had temporarily also considered an IPO. In 2016, the planned was a failed merger with the E. R. Capital Holding of Bertram’s brother Erck Rickmers. Together one of the largest shipping companies in Europe.