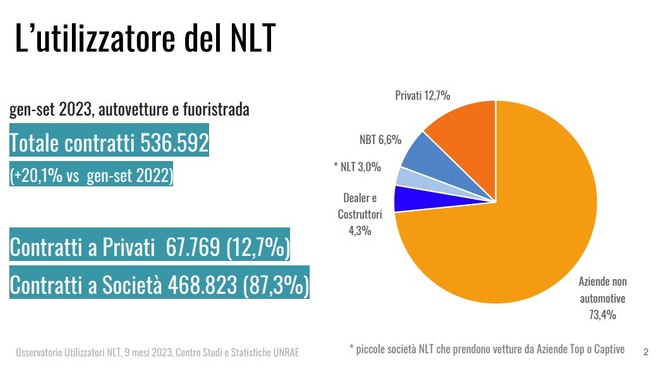

In Italy, long-term rental is increasingly popular. as a solution to have a car. The latest photograph of this market in Italy, taken by UNRAE, highlights the good state of health of the long-term rental sector given that from January to September 2023 there were 536,592 contracts were registered. We are talking about a growth of 20.1% compared to the same period of 2022.

In particular, 67,769 contracts (12.7%) were stipulated by Private users (-1 .3% compared to 9 months 2022). The remaining part, however, 468,823 contracts (87.3%) from companies.

Within the latter, the largest share goes to non-automotive companies with 393,715 contracts and a share of 73.4% (+29.0% on 2022). The share of short-term rental companies (NBT) rose to 6.6% with 35,653 contracts (+38.4%) and that of Dealers and Manufacturers rose to 4.3% with 23,271 contracts (+34.3%). while it is more which halved to 3% the share of long-term rental companies (NLT) which registered 16,184 contracts (-45.4%).

How long do long-term rental contracts last on average? According to the latest UNRAE analysis contained in the NLT Users Observatory, we are talking about 23 months, slightly more than long for the two main channels, Private individuals 25 months and Non-automotive companies 24 months.

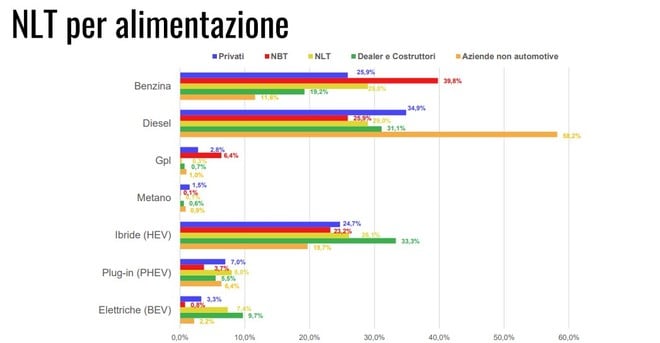

DIESEL IN FIRST PLACE

By entering more in detail, the report highlights how diesel is still in first place among the various fuels, thanks above all to non-automotive companies where models with this power supply are the most popular. requested (58.2%) although decreasing compared to the same period in 2022. Diesel is also in high demand among other users: private 34.9%, NLT 29.0% and NBT 25.9%.

The share of petrol models is growing in all channels. These cars are the predominant choice particularly in the NBT with 39.8%. LPG also performed very well in the NBT category. Yes it is went from a share of 0.9% in the first months of 2022 to 6.4% in the first 9 months of 2023.

Electric cars are not good. BEV models, in fact, lose positions among private individuals (to 3.3% from 4.0%) and in the NBT (to 0.8% from 1.2%), and record a significant drop among the major users of BEVs, i.e. Dealers and Manufacturers who almost halve their share, falling from 17.6% in 2022 to 9.7% today.

At the same time, Dealers and Manufacturers increased their share of hybrids (HEVs) from 25.3% to 33.3%, models that are increasingly popular among consumers. so much so as to undermine the second position of petrol vehicles.

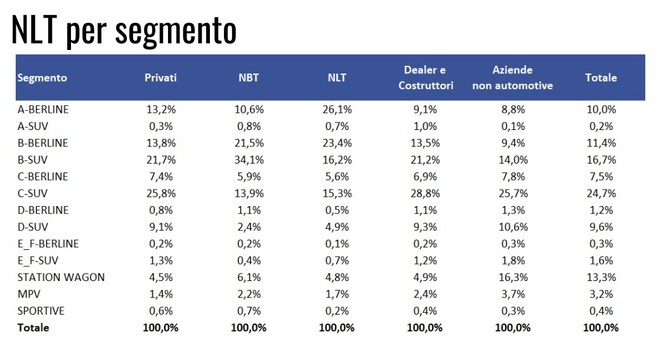

Lombardyis the region with the greatest weight in long-term rental, with a market share of 33.0%. Next we find Lazio (14.1%) and Piedmont (9.2%). Among the provinces, in first place we have Milan with 24% of contracts, in second place Rome with 13.2% and in third place Turin with 7.0%. Finally, the report highlights that the preferences of C-segment SUVs are increasing, occupying first place in the Private (25.8%), Non-automotive Companies (25.7%) and Dealers and Manufacturers channels (with the share rising from 16.0% to 28.8%). In the NBT, the preference for B-segment SUVs continues to prevail (34.1%), and in the NLT that for A-segment sedans (26.1%).

The most popular smartphone? business suit? Samsung Galaxy S23 Ultra, buy it at the best price from eBay at 958 euros.