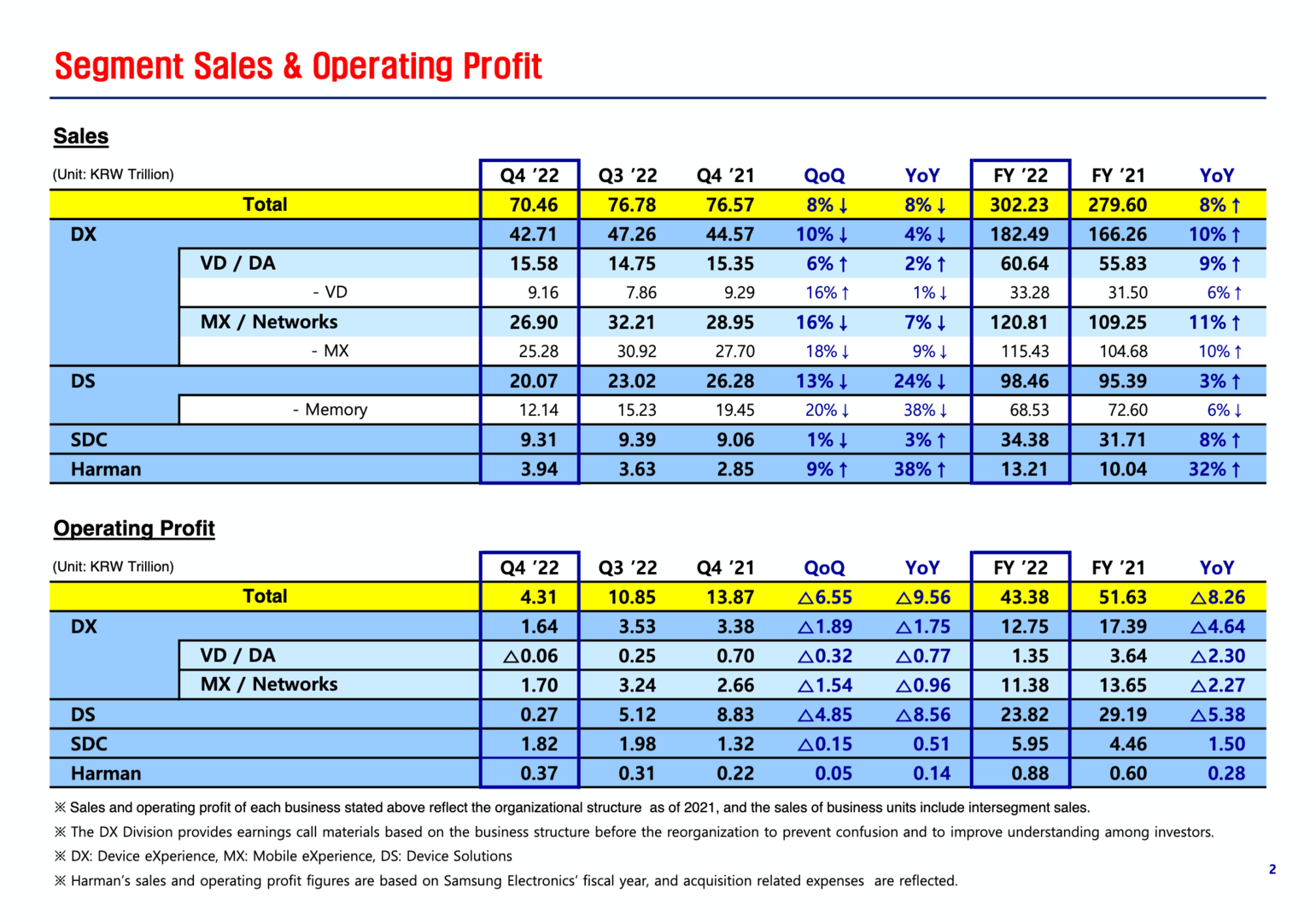

38 percent less sales of DRAM and NAND have almost zeroed the profit of this division. Nevertheless, Samsung can still complain at a high level, other areas continue to increase sales, so that in the end, at least here, there is only a small minus. But the profit stands and falls with the storage division.

Only 0.27 trillion won of profit is left in the memory division from 8.83 trillion won a year ago — down nearly 97 percent. However, since this area has always been responsible for half of the group's profits, it quickly becomes clear what this means for Samsung Electronics' overall figures.

Storage prices are collapsing..

The details in the memory division are extremely interesting. Because sales “only” fell by 38 percent, but the problems are simply home-made: Samsung has delivered even more bits to the market, but the average price has deteriorated rapidly. The massive collapse in demand, as recently clearly visible at Intel, led to a 30 percent lower average price for DRAM and over 20 percent for NAND. It ended up eating up almost the entire profit.

.. but Samsung doesn't change anything

But Samsung, unlike the other two major manufacturers SK Hynix and Micron, is not giving in and is once again putting recent rumors about production cuts on hold. There should be no cutbacks in production, nor should other major measures be taken. As recently discussed by some analysts, Samsung seems to be taking the opportunity to improve its position in the market at the expense of the other two, which they cannot or do not want to afford. Because after the crisis there is always an upswing – at least Samsung hopes so too.

This is a great opportunity for us to prepare for the future.

We continue to make the infrastructure investments that are necessary to respond to mid-to-long term demand, and to secure the essential clean rooms that we would need to do that. So in conclusion, this year's (capital expenditures) plan is expected to be similar to previous years

Samsung

But hardly any company sees the near future as rosy as Samsung sees it. According to Samsung, there should be an improvement here and there as early as the second quarter, but it should be visible on a large scale by the second half of the year at the latest. But not everyone believes in it, the current quarterly figures show that some companies have not even bottomed out. First of all, the huge inventory, which has crossed the 200-day mark at some companies, has never been there before and will take much more time to deplete.

Other areas are also weak

Samsung Electronics does not only consist of memory, but many other things , especially TVs, smartphones and white goods. However, Samsung was also able to generate lower sales in all of these market segments in the fourth quarter of 2022, while profits also fell at the same time. Samsung's outlook is a bit more realistic in these areas, however, further declines are expected not only seasonally but also due to the circumstances in the world with a recession in many countries and high inflation. Samsung Electronics, like Intel and others recently, does not yet dare to provide an outlook for the entire year for the entire group.

Samsung Revenue and Operating Profit (Image: Samsung)

Samsung Revenue and Operating Profit (Image: Samsung)