It's a bombshell that Intel presented last night: a significant drop in sales means hundreds of millions of dollars in losses, the company wants to focus on its long-term goals. However, further sidelines will be closed, first of all the Tofino chips that drive network products.

The core business collapses

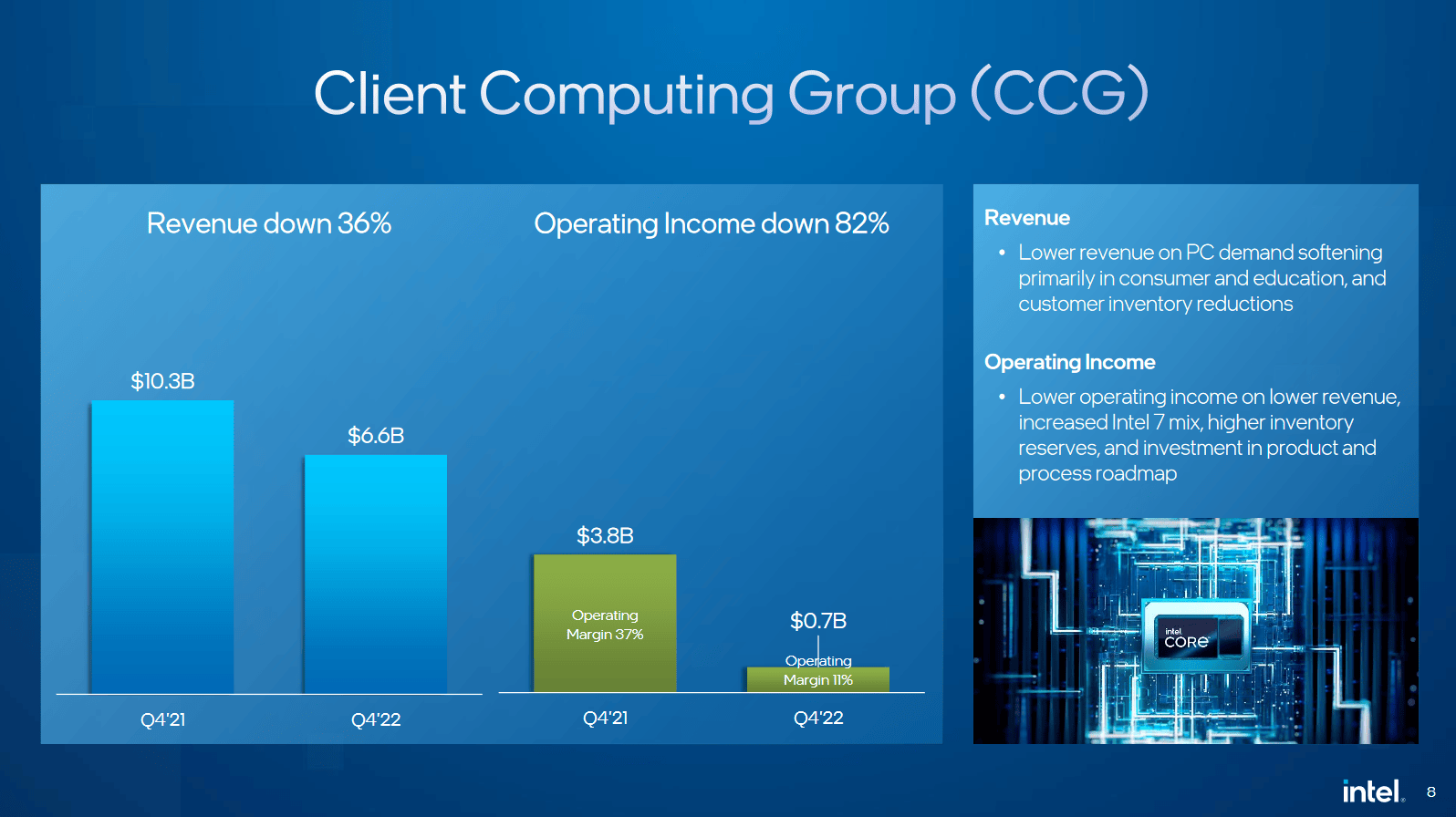

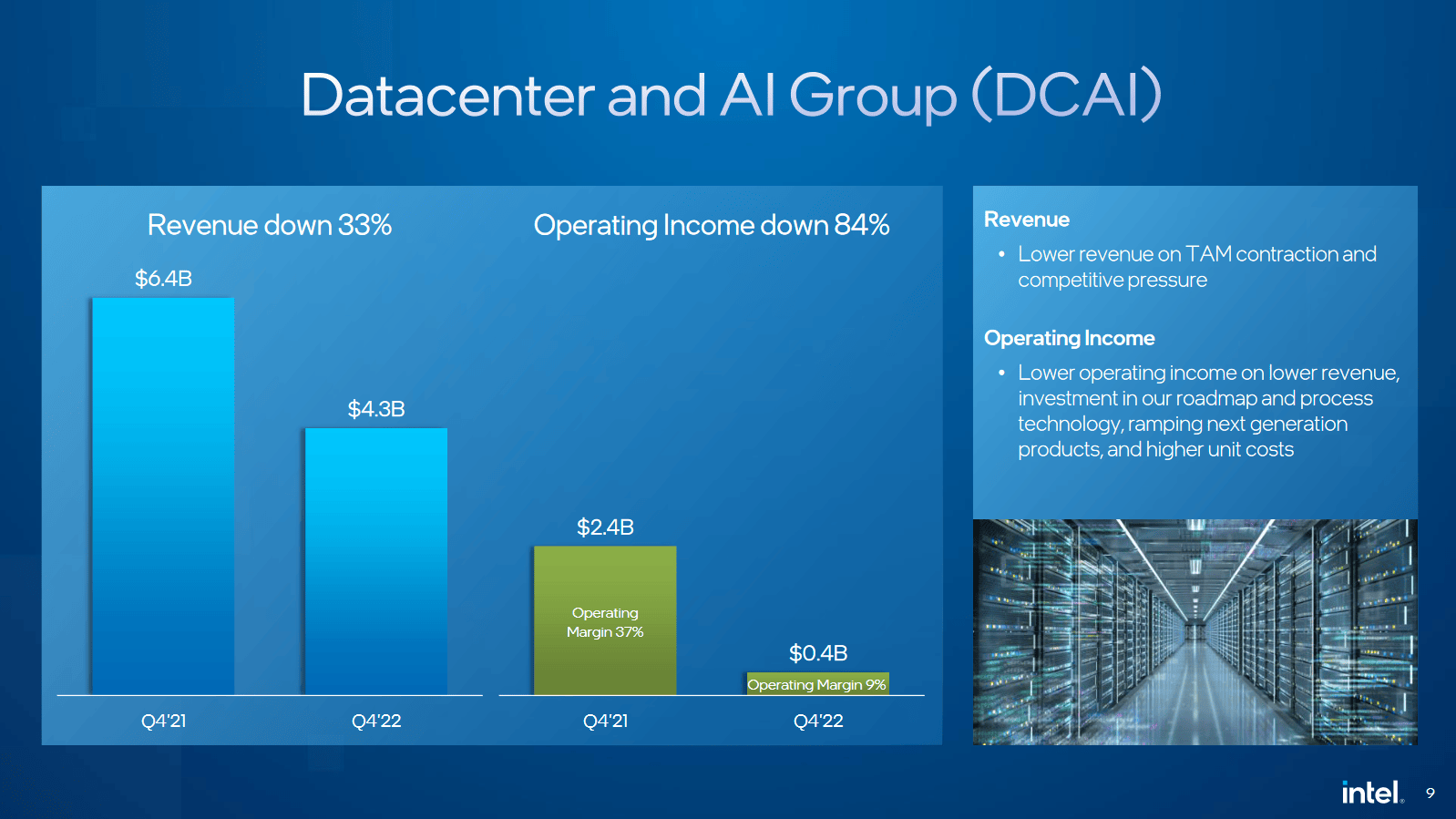

It's a brutal slump, even the forecasts have only seen this in the worst case scenario. The personal computer business has collapsed, falling from $10.3 billion to $6.6 billion, almost eating away at profits in the process. In percentage terms, however, the data center division is just as bad, with a 36 percent drop in sales accompanied by an 84 percent drop in operating profit.

CCG is barely making any profit (image: Intel)

CCG is barely making any profit (image: Intel) DCAI crashes (image: Intel)

DCAI crashes (image: Intel)Sideshows also had a difficult time from time to time. Intel's graphics division, which was particularly popular in the media, only made 2 million US dollars more sales within one year than in the previous year. With sales of $247 million and a loss of $447 million per quarter, this still means that business is anything but good here. The only lighthouse project that remains is the automotive division Mobileye with a sales increase of 59 percent and significantly more profit than before.

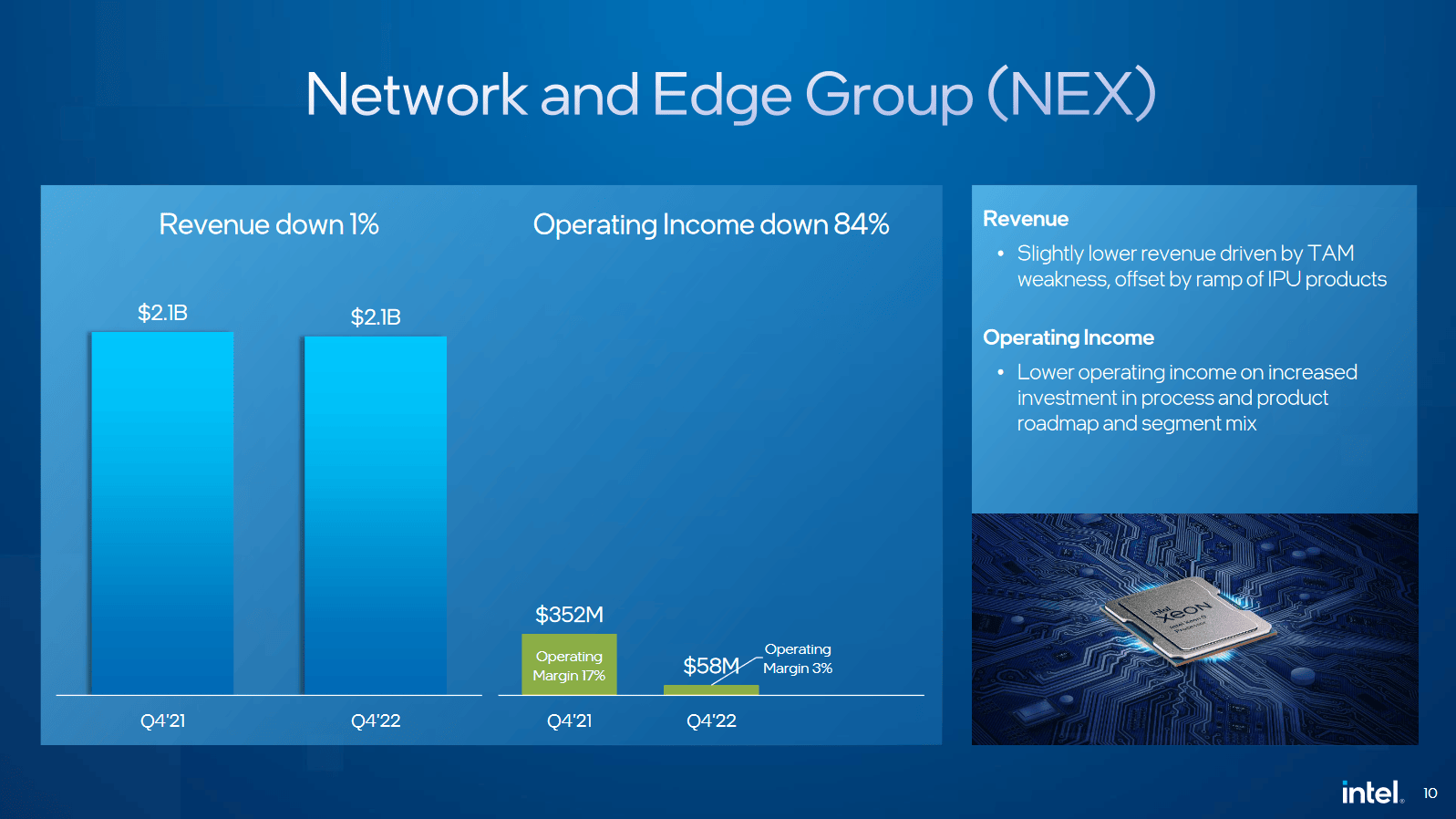

NEX (image: Intel)

NEX (image: Intel) Other Business Units (Image: Intel)

Other Business Units (Image: Intel)Bottom line, Intel only made $14.042 billion in revenue in the fourth quarter, down from $20.528 billion a year ago. A net profit of 4.623 billion US dollars has become a minus of 664 million US dollars. And the prospects remain gloomy: Intel only expects sales of around 11 billion US dollars in the first quarter of this year, and another loss. The discrepancy is even greater here, a year ago sales were still 18.4 billion US dollars – so Intel has not yet reached its low point.

Intel: sales and profits since Q1/2003 -1,0003,80016.60021,000 million $ Q1/2003/2004Q3/2005Q3/2006Q1/2007Q1/2008Q1/2009Q3/2009Q1/2010Q3/2010Q1/2011Q1/2012Q1/2013Q3/2014Q3/2015Q3/2015Q1/2016/2016Q3/2017Q1/2017Q1/2019Q1/2019Q1/2020Q3/2021Q1/2022Q3/2022

- Revenue according to US GAAP

< li class="svgchart__item js-svgchart-item" data-item="381506"> US GAAP Net Income

The thumbscrews are tightened further

Therefore other branches of business have to believe in it. As CEO Pat Gelsinger explained in the conference call on the quarterly figures, it is now the turn of the Tofino chips.

We will end future investment on our network switching product line, while still fully supporting existing products and customers. Since my return, we have exited seven businesses, providing in excess of $1.5 billion in savings.

Pat Gelsinger, Intel CEO

It is eagerly awaited which further savings measures Intel could present in the coming weeks. So far there have been reports of hundreds of job cuts at certain locations, and a smaller research facility in Oregon will no longer be built. However, the focus is on the major projects like all newly planned fabs. In view of the development, it seems difficult to imagine that all of this will really be implemented as planned. Other ancillary sites such as RISC-V support will also be discontinued.

Recommended External Content  Twitter

Twitter

This is an external content from Twitter, which complements the article and is recommended by the editors. It can be loaded and hidden again with one click.

Load Twitter embeds I consent to Twitter embeds being loaded. Personal data can be transmitted to Twitter. More on this in the data protection declaration.

Intel abandoned pathfinder for RISC-V Program pic.twitter.com/jPGZ6JhCe9

&mdash ; Yusuke Ohara/大原 雄介 (@YusukeOhara) January 26, 2023

Loading Twitter Embeds Privacy Policy