What will happen in the future in the semiconductor industry, which, like many customers, is currently in the midst of a downturn? ASML, as the factory outfitter for all major manufacturers, provides some answers in the quarterly report. New orders for almost 9 billion euros are already showing a positive trend.

Large-scale new orders and huge order backlog

It is probably the clearest indicator that the semiconductor manufacturers only see the current phase of weakness as a temporary problem. New orders for lithography systems for EUR 8.92 billion not only mark far more than ASML can handle in one quarter, they are also higher than the second quarter of this year, when orders for EUR 8.4 billion were landed. The backlog now includes orders worth over 38 billion euros and theoretically it takes almost two years to be processed without receiving additional new orders.

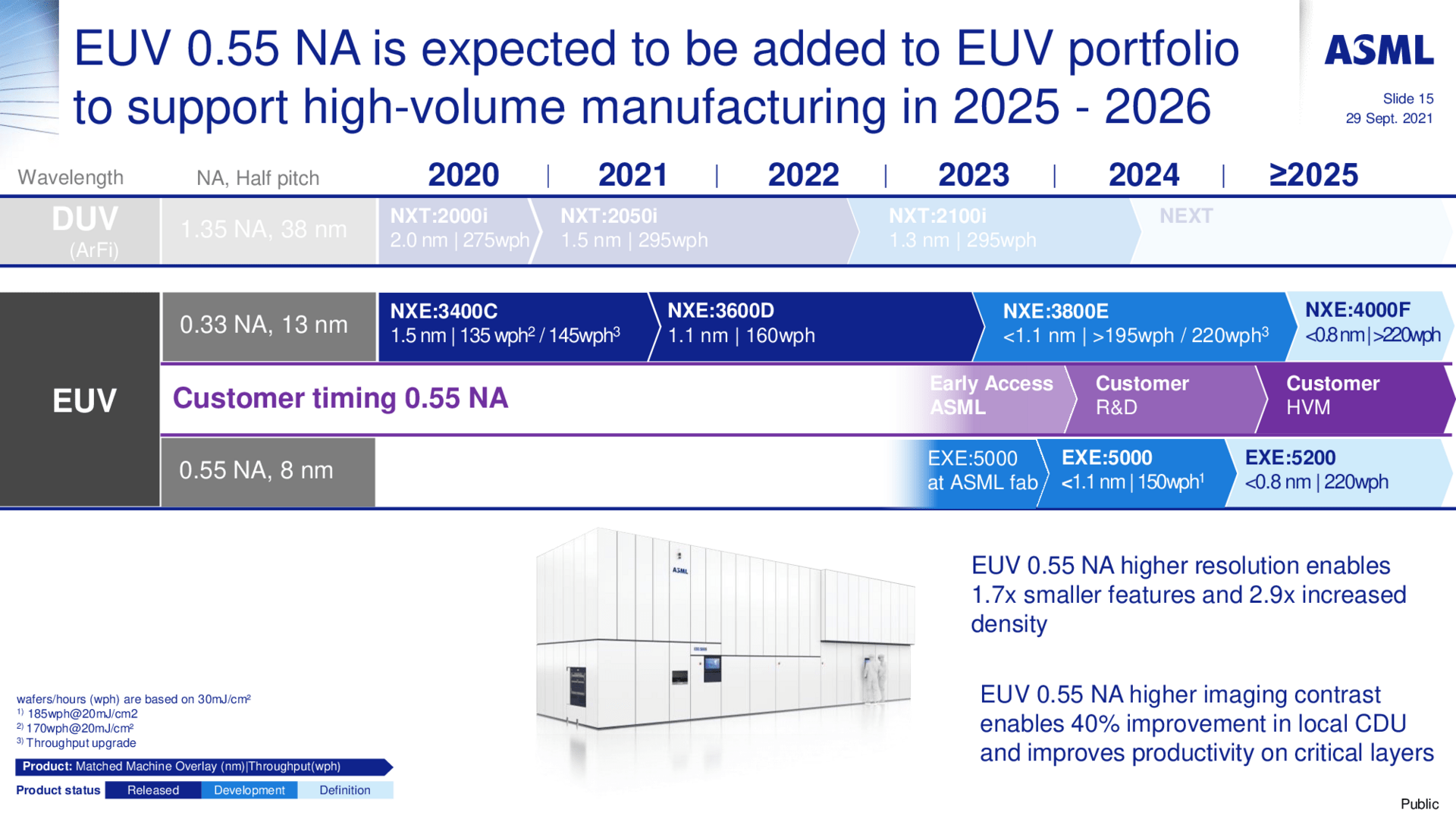

In the third quarter, 3.8 billion euros are attributable to new orders for EUV systems, including the most modern but also much more expensive high-NA solutions, led by the first series device, the Twinscan EXE:5200. According to ASML, all previous customers of EUV systems have now also committed to using the new high-NA solutions. These are not mentioned by name in the quarterly report, but TSMC, Intel, Samsung, SK Hynix and Micron rely on ASML scanners and will not work without EUV in the coming years.

-

High NA systems on ASML's roadmap (Image: ASML)

High NA systems on ASML's roadmap (Image: ASML)

Image 1 of 2

< figure class="text-asset text-width text-asset--with-border-bottom">

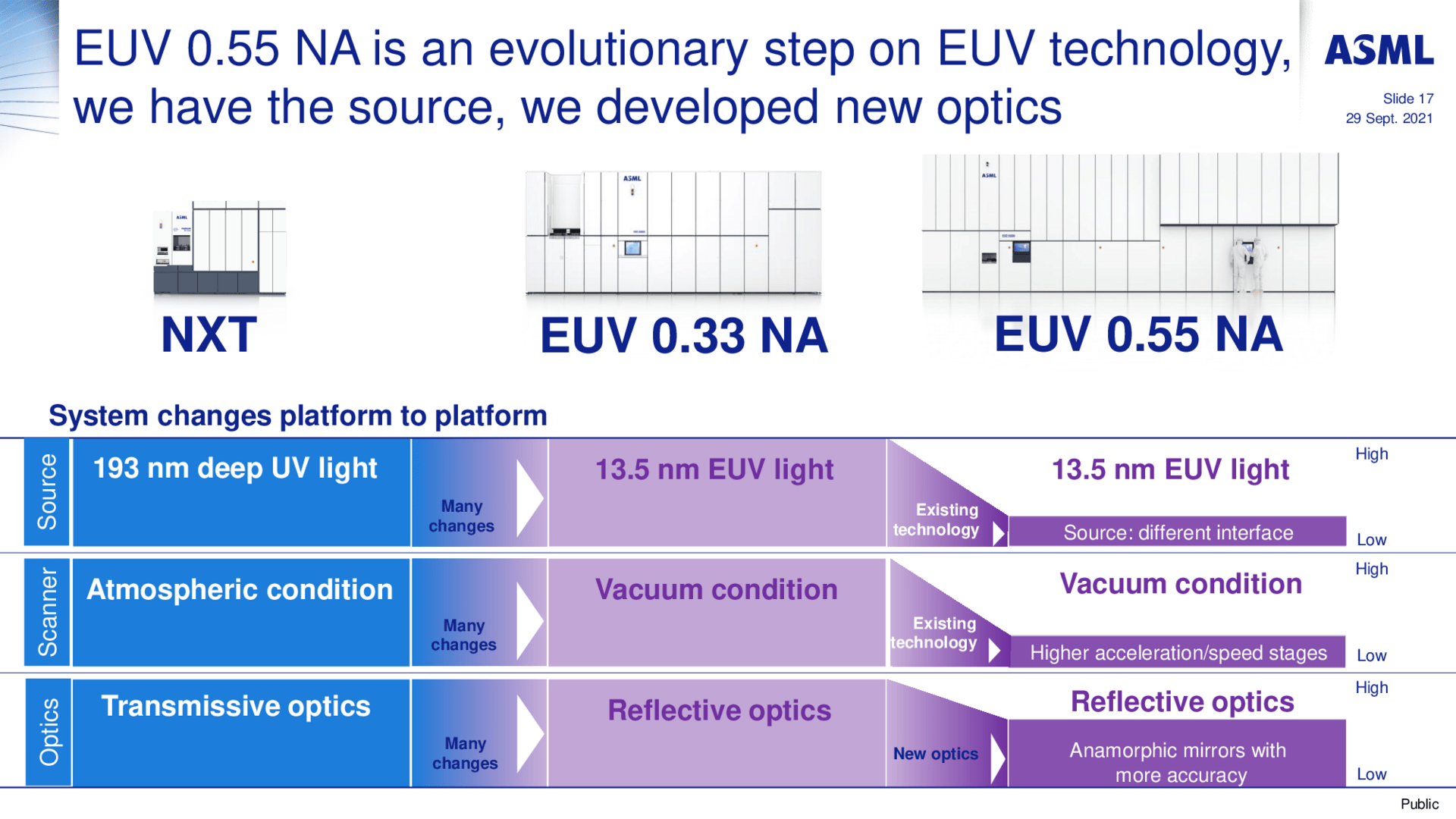

More similarities between the systems (image: ASML)

More similarities between the systems (image: ASML)The already mentioned period of time for processing the order backlog allows ASML to increase the capacities as previously communicated. The aim is still to deliver 60 EUV systems and 375 DUV scanners in the coming year. In the long term, 90 EUV systems and 600 DUV scanners are to be built per year from 2025, plus around 20 High NA systems per year in the years to come.

The China question remains spongy

The semiconductor industry is also boiling up in the media about the new US sanctions towards China. ASML's CEO also briefly comments on this, but remains vague as to what the group's final decision is. The group is currently likely to continue to send systems without EUV to China, but the question is whether it should. Theoretically, this currently works without it, because demand exceeds supply.

But the fact that we are a European company with limited US technology in it of course creates this situation where a direct impact on us is fairly limited. We can continue to ship non-EUV lithography tools out of Europe into China.

So the direct impact on us I would say is fairly limited. Of course there could be indirect effects. Those indirect effects could be that Chinese manufacturers to the extent that they do not get other equipment that they need in their fabs for instance from the United States. Of course there could be an indirect effect on the demand for our tools. But there I would say, it is important to recognize that we are clearly still in a situation where the supply is below what the demand is. So to the extent that at a certain point in time we would be in a position that we can no longer supply certain tools to certain customers in China, the demand outside of China is still such that we would get compensation for that in the current environment from other customers.

ASML

Quarter exceeds expectations

With At the end of the third quarter, ASML not only exceeded the previous ones with sales of 5.8 billion euros, but also its own forecast and that of analysts. However, net profit stagnated at a high level of 1.7 billion euros, higher expenditures, especially for research and development, an increase of more than 34 percent compared to the same quarter last year, are eating away at it. Things are set to continue in a similar way in the fourth quarter, with slightly increasing expenses and increased sales of between EUR 6.1 and 6.6 billion.