There is no only the new car market to be in trouble; in Italy. Even the used one is experiencing a complex period. UNRAE took a photograph of the Italian second-hand market in the first 7 months of 2022 from which a negative balance of ownership transfers emerges. of cars. Specifically, there is talk of a decline of 12.6% to 2,631,518 units & agrave; compared to 3,011,063 in the same period of 2021. Decrease of 13.6% for net transfers and decrease of 11.3% of mini-crops.

PREFERENCE TO DIESEL

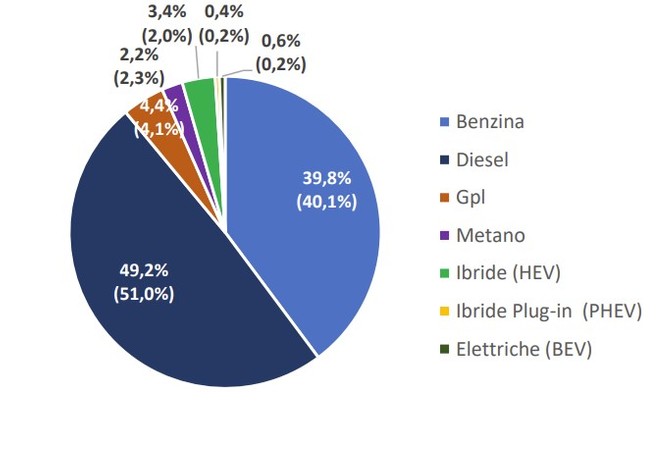

Going into the details of the UNRAE report , it turns out that the preference of Italians & egrave; for used cars equipped with a diesel engine . These models account for 49.2% of transfers (down from 51% in 2021). Petrol models follow (39.8% against 40.1% in 2021). The GPL, on the other hand, can & ograve; count on a share of 4.4% (4.1% in 2021). Hybrids (HEVs), on the other hand, have a 3.4% share (2% in 2021).

Methane stops at 2.2%, while net transfers of electric cars (BEVs) rise to 0.4% and Plug-ins to 0.6%. As regards contractors, however, the report highlights the sharp increase in transfers between private individuals, with a share of 56.7% (46% in 2021). This increase is essentially due to the lower availability; of cars at the sales networks .

In fact, transfers from operator to end customer drop to 38.8% (48.7% in 2021). Transfers from rental are essentially stable (0.7% overall), while those from Km0 lose half a point (at 3.9%). And looking at the data at the level of the regions, it turns out that 35% of the ownership changes; in the first 7 months of 2022 & egrave; occurred in Lombardy, Lazio and Campania. All regions show a decline in volume by 2021.

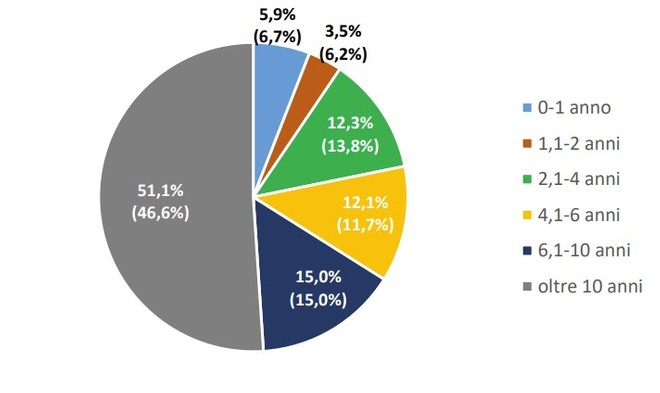

Used cars are increasing and ugrave; old . This is certainly not a positive sign. In fact, the report highlights that the exchanges of cars with over 10 years of seniority; they are positioned around 51% of transfers. An increase compared to 46.6% in 2021. The share of cars from 6 to 10 years is stable at 15%, while that of cars from 4 to 6 years old (12.1%) is further recovering. The share of the largest cars is down recent, in particular those from 1 to 2 years (at 3.5%), for the reduction of Km0.

On the mini-turnover front , the share of private individuals or other companies remains very high; who exchange their cars, with 61.6%, while the share of car withdrawals by operators is reduced to 27.5%. Minivoltures of diesel cars are losing ground which, in the first 7 months, drop to 53.8% (57.3% in 2021). Petrol and LPG slightly increased. Minivolture of cars is growing with more; 10 years, which rise to 40.4% of the total, to the detriment of all other seniority brackets.

5G without compromise? Oppo Reno 4 Z, buy it at the best price from Amazon Marketplace at 384 euros .