The technology industry is divided. While some are posting massive declines, others continue to see a bright future. In addition to TSMC as the largest contract manufacturer for semiconductor chips, Foxconn and the Hon Hai Technology Group are also the group that ultimately manufactures the products for many companies.

In its quarterly report, the group not only presents strong figures, but in these current times an interesting because very positive outlook with an increased forecast for the rest of the year. So far, the group has cautiously assumed that sales will be similar to last year, so it is looking to the future with corresponding optimism.

A sales giant with a low margin

The stock market surprised Foxconn with an increased profit. 33.3 billion New Taiwan dollars, the equivalent of around 1.1 billion US dollars, is more than any analyst had previously suspected. The margin in the operating area increased significantly compared to the previous year, but is still at a very low level, especially compared to other companies. But that's Foxconn's business model of being the cheapest manufacturer, so countless suppliers of a certain product in various industries use Foxconn's services at some point. Because the difference between profit and sales only becomes clear when the sales in the same period are considered: 1.51 trillion New Taiwan dollars are here, the equivalent of around 50.3 billion US dollars, that Foxconn generated in the second quarter of this year which marks an increase of twelve percent over the previous year.

Second quarter in detail (Image: Foxconn)

Second quarter in detail (Image: Foxconn)Foxconn is a little further away from the problem areas that Intel, Nvidia and Micron are currently feeling. Their business with classic components also declined, and in the second quarter it was below expectations. However, it only makes up six percent of the business, and the fluctuations are easily cushioned by other areas. Above all, the smartphone business did not collapse as much as expected, accounting for the largest share of sales at around 50 percent. The biggest growth drivers are the cloud and network infrastructure.

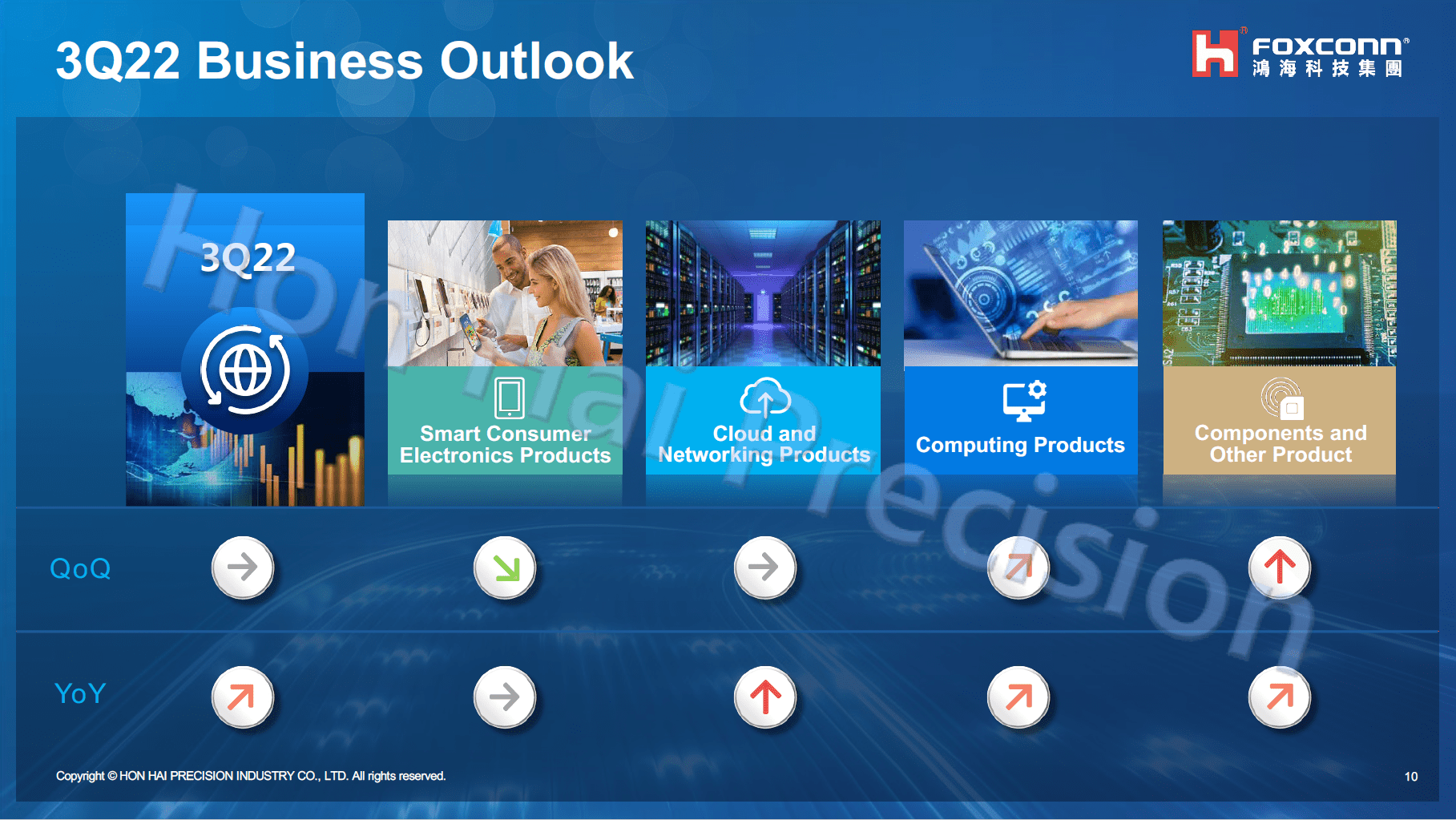

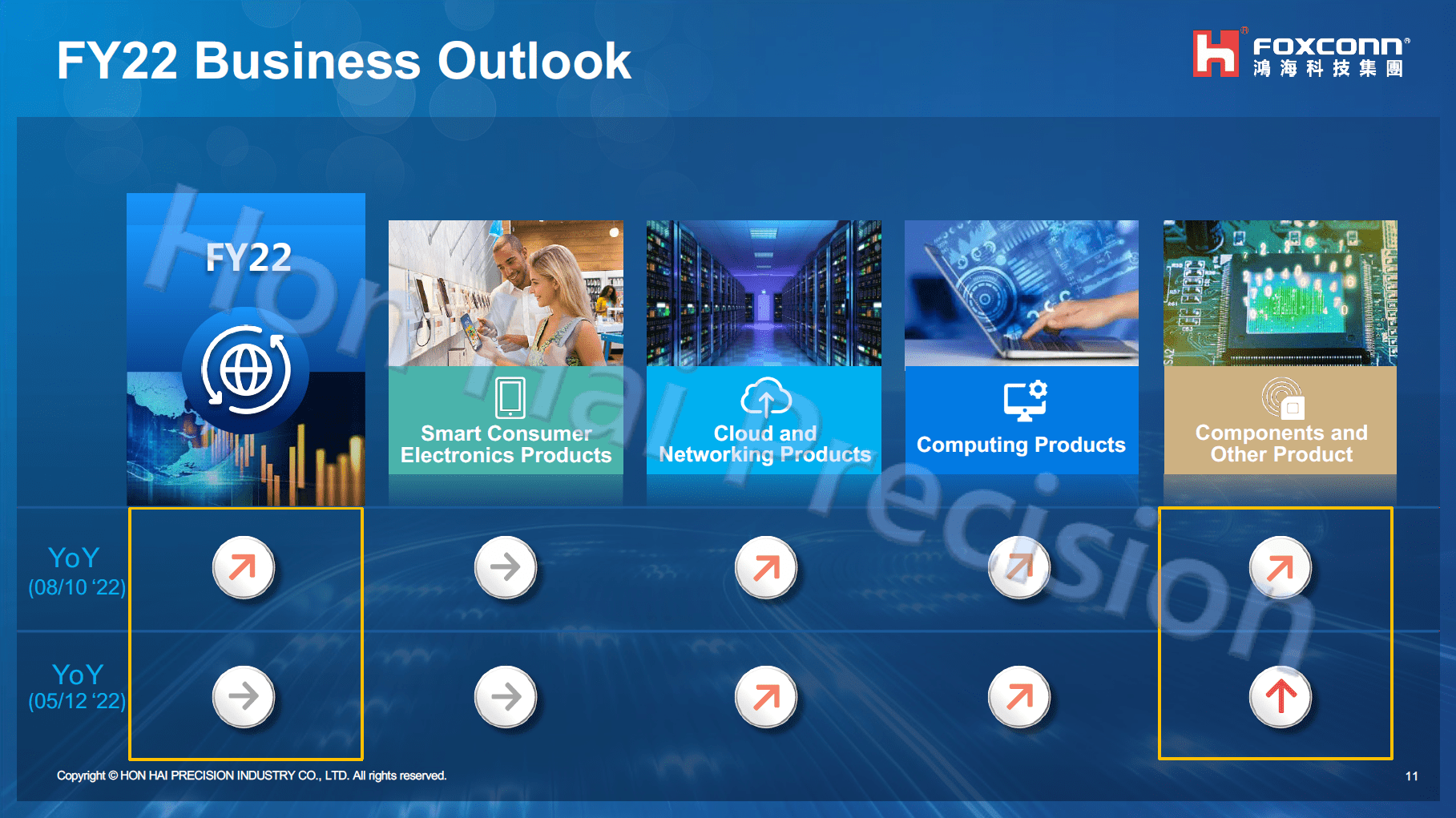

But Foxconn's forecasts are interesting. In the current third quarter, of all things, the components segment is expected to pick up significantly again and the PC business should also grow steadily, both in comparison to the second quarter and to the previous year. This should remain the case over the course of the year, so that this segment of all things will tip the scales and Foxconn, together with the additional sales already taken into account for cloud, network and PC products, is now helping to make a better forecast.

Q3 forecast (image: Foxconn)

Q3 forecast (image: Foxconn) FY22 forecast (image: Foxconn)

FY22 forecast (image: Foxconn)It is therefore not so easy to predict which company will ultimately have problems in the coming weeks and months. Large inventories on the one hand can have a massive impact on this equation, which is one of the reasons why AMD is currently better off than Nvidia and Intel – they have always been limited in chip shipments and have not been able to build up large inventories at all. However, the coming weeks will reveal how this develops.