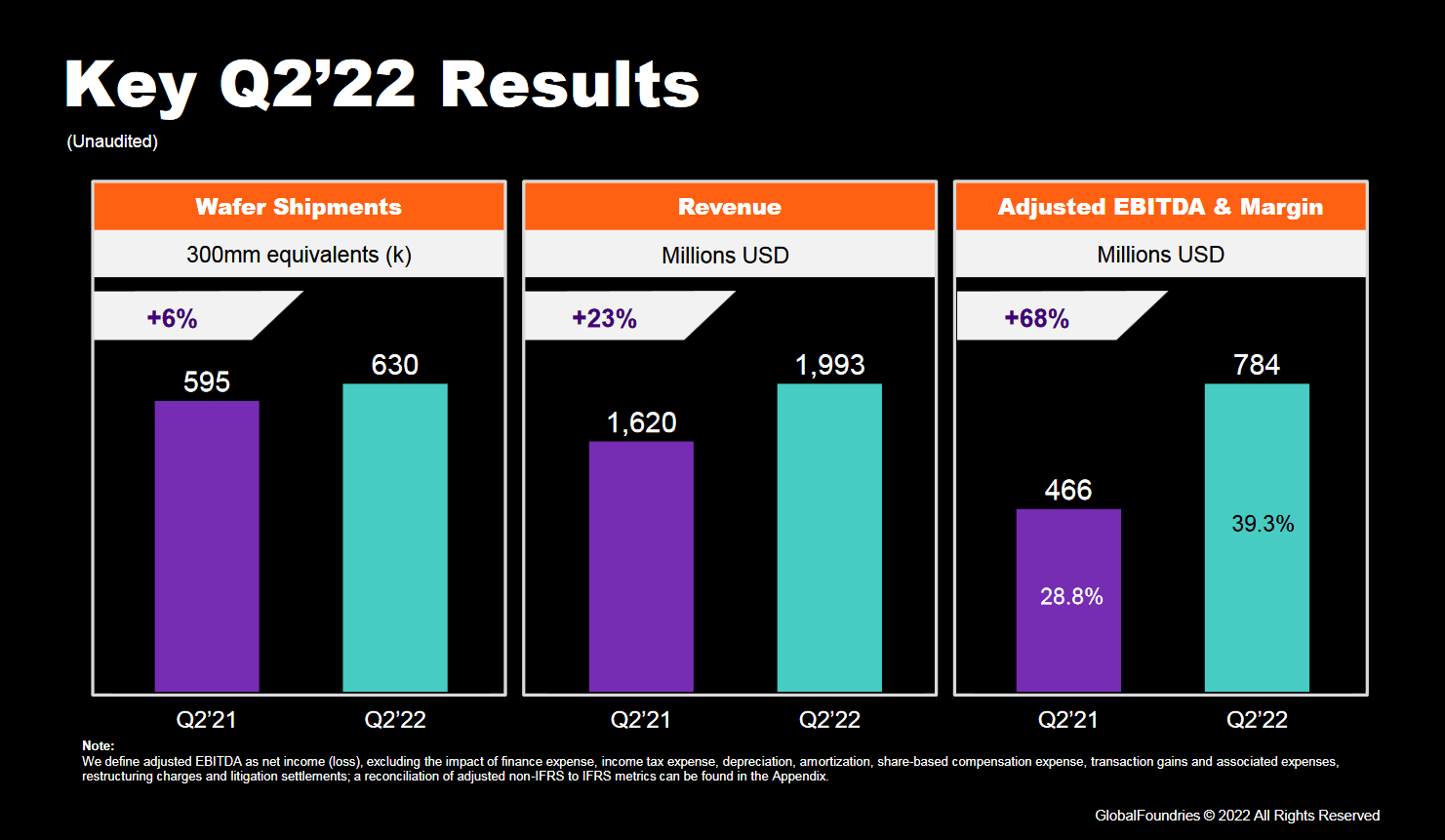

23 percent more sales than in the previous year help Globalfoundries achieve record sales. The profit is also finally moving along, a year ago it was still slightly in the red and today there are 317 million US dollars in net profit on the books.

Long-term contracts serve as the backbone

Long-term contracts are what Globalfoundries will use to earn money now and in the future. For example, the recently concluded and expanded agreement with Qualcomm has a total order volume of US$7.4 billion by 2028. Overall, Globalfoundries has collected many long-term contracts (LTA) with a volume of over US$24 billion, they form the massive backbone in the coming years and are thus able to lift many of the company's future plans.

630,000 exposed wafers in the last quarter

These not only provide for the expansion of existing factories, but also for new buildings. The first tools are being installed in the enlarged facility in Singapore (see title picture), and the joint venture with STMicro to operate a factory in France was recently officially decided.

For good According to Globalfoundries, the plants in the USA and Germany primarily contributed to the quarterly result, both of which grew in double digits and thus, in addition to the already largest complex in Singapore, contributed the lion's share of the 630,000 exposed wafers in the last quarter.

Only six percent more exposed wafers ultimately generated much more sales than a year ago, which speaks for an increased average price.

Globalfoundries in Q2 2022 (Image: Globalfoundries)

Globalfoundries in Q2 2022 (Image: Globalfoundries)In the end, Globalfoundries outperformed with the Quarterly results all expectations, the group posted 1.99 billion US dollars for the last three months.

In the current fourth quarter, things should continue to improve, with sales of more than 2 billion US dollars being targeted. It is important for the company that the margin is now also increasing significantly and that profits will continue to be made in the future.

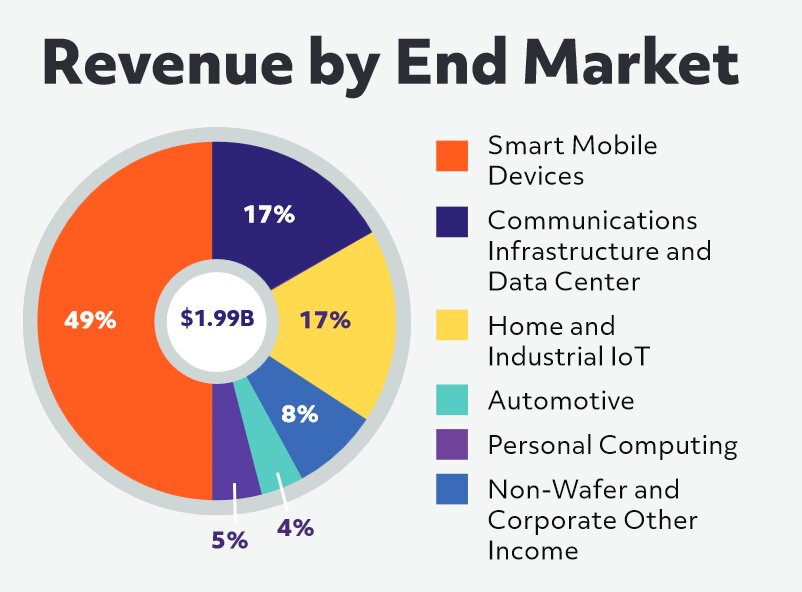

Focus on communication and automotive

Because Globalfoundries is still sitting on a huge debt mountain of many billions of US dollars, which will take many years to reduce. In the future, too, Globalfoundries will primarily focus on the communications industry, the professional and IoT sector and the up-and-coming automotive business. The PC division is being cooked on a steadily smaller flame with AMD, which will soon be leaving Globalfoundries.

Sales by division (image: Globalfoundries)

Sales by division (image: Globalfoundries)