TSMC is no longer on everyone's lips in the IT sector, as you can see from the quarterly report: Thanks to huge demand and the continuing shortage of chips, sales and profits continue to grow strongly.

16.3 percent more sales to 14.88 billion US dollars mark another milestone for a third quarter. The profit also went up again, the production of chips for others poured over 5.6 billion US dollars into the coffers in the three months and even exceeded the highest expectations. Growth in the first nine months of 2021 was 17.5 percent in sales and 14.8 percent in profit.

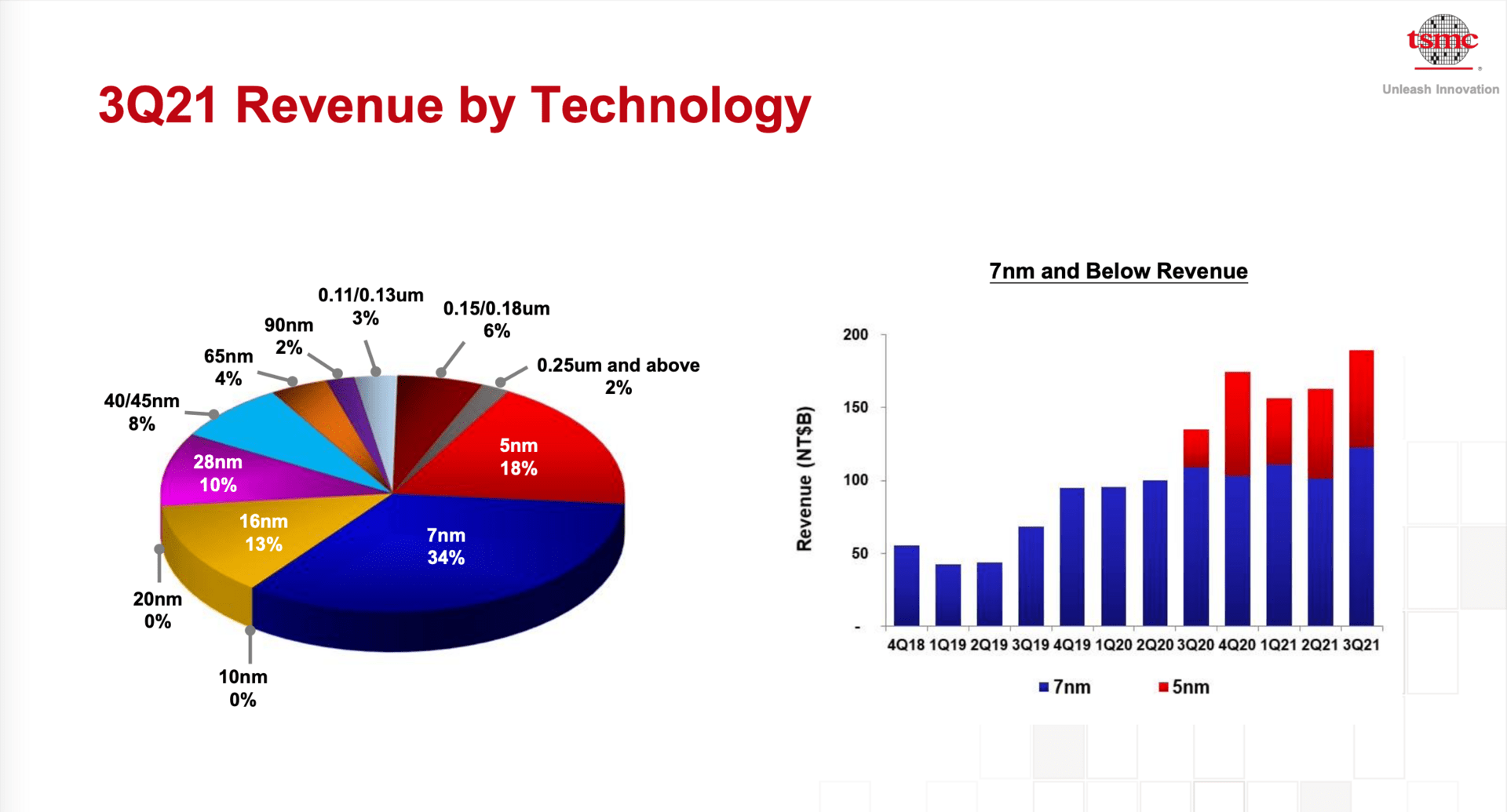

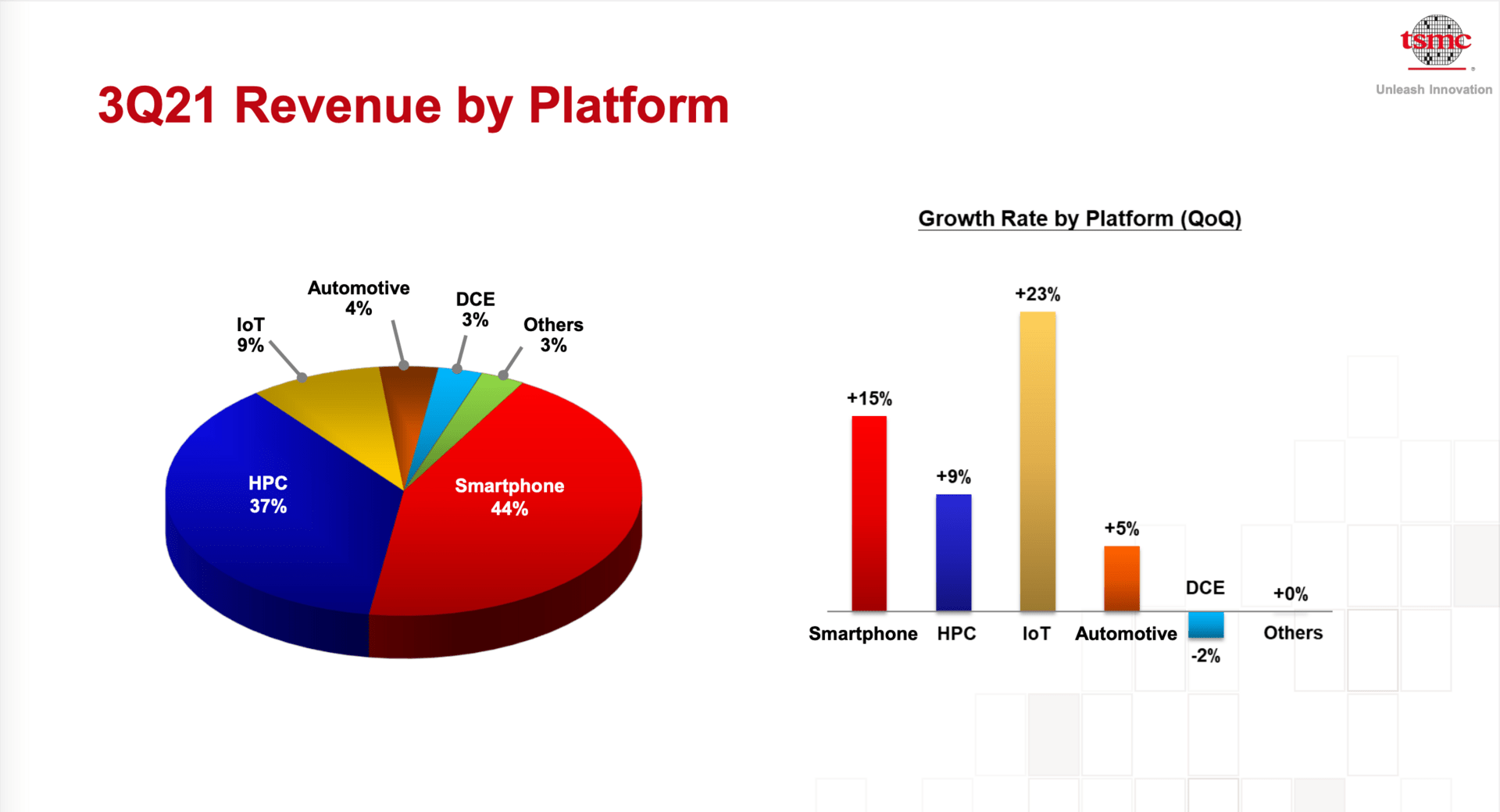

Where the growth comes from can also be seen in the quarterly report: TSMC has also exposed and shipped 12.5 percent more wafers in the three months, which in the end have a more than 1: 1 impact on sales and profit. A new record was also set with 3.646 million 300 mm wafers or their equivalent. It is clear that most of the sales come from 5 and 7 nm production. These two manufacturing stages account for 52 percent of total wafer sales and just hit the 200 billion New Taiwan dollar mark. Components for smartphones and PCs, servers and notebooks are the main buyers.

Sales by technology level (Image: TSMC)

Sales by technology level (Image: TSMC)  Sales by platform (Image: TSMC)

Sales by platform (Image: TSMC) In the fourth quarter, sales should continue to grow, up to $ 15.7 billion. The margin should remain high, which is why profits should continue to bubble up.

Japan factory and N3 production

< p class = "p text-width"> In the conference call on the quarterly figures, TSMC's CEO CC Wei officially confirmed plans for the new factory in Japan. It will be designed for 22 to 28 nm. Construction is to begin at the beginning of 2022 and production in the factory will start in 2024.

The new production stages N3 and N3E will be finished on time, both for the smartphone and PC segment. Risk production will begin this year, with mass production in the second half of 2022 – in time for the next Apple iPhone 14.TSMC expects more tapeouts for the new N3 production stage within a year than in the same time frame after the launch for N5.

N3 should then be followed by N3E within a year, i.e. it should be ready for series production from mid-2023. An even higher performance and better yields characterize the follow-up process from N3. For the first time, TSMC is also underpinning rumors that one could take an intermediate step before switching to Gate-All-Around (GAA). This has already been rumored to be N2.5. TSMC did not want to comment on GAA when asked, but an N2 process does not seem realistic until the end of 2024 at the earliest, with larger volumes in 2025. The cycle times are apparently also longer at TSMC, which gives the competition the chance to catch up .