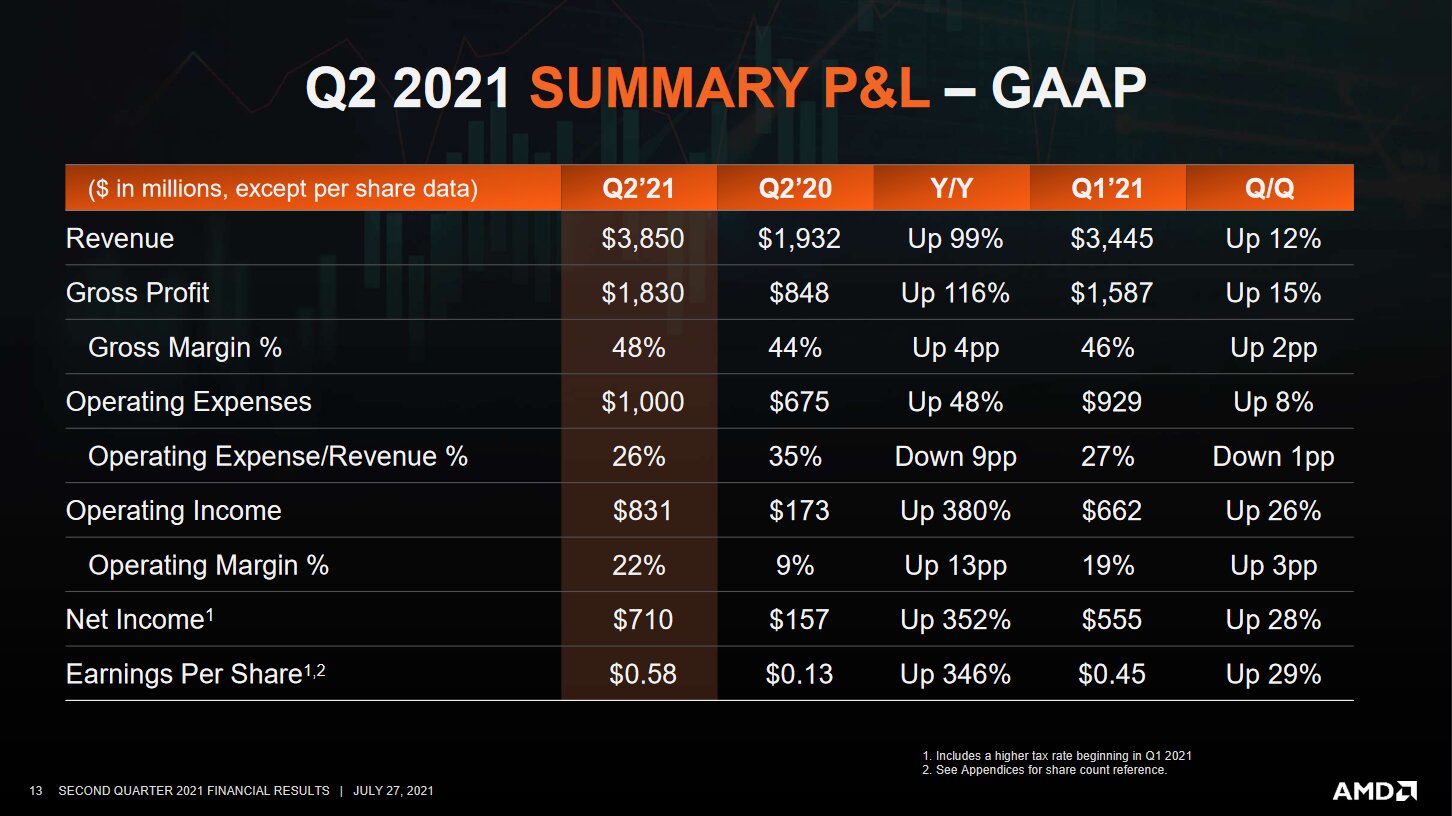

The second quarter of the year brought AMD once again more sales than expected and again strong growth compared to the previous year in all segments. The gross margin also increased again slightly compared to the same period in the previous year. With a turnover of 3.85 billion US dollars, expectations were exceeded.

99 percent more sales and high profits

< p class = "p text-width">AMD boss Lisa Su was delighted with the extremely positive business result, which shows that the company was able to increase its total sales by an impressive 99 percent in a direct year-on-year comparison. Operating income, in turn, was $ 831 million, a margin of 22 percent.

AMD: Sales and Profits since Q4/2003 -2,000-8303401.5102.6803.850 Q4/2003Q2/2004Q4/2004Q2/2005Q4/2005Q2/2006Q4/2006Q2/2007Q4/2007Q2/2008Q4/2008Q2/2009Q4/2009Q2/2010Q4/2010Q2/2011Q4/2011Q2/2012Q4/2012Q2/2013Q4/2013Q2/2014Q4/2014Q2/2015Q4/2015Q2/2016Q4/2016Q2/2017Q4/2017Q2/2018Q4/2018Q2/2019Q4/2019Q2/2020Q4/2020Q2/2021 sales (ASC 605) net profit (ASC 605) sales ( ASC 606) Net Income (ASC 606)

The net income in Q2 in 2021 was around 710 million US dollars (GAAP) and 778 million US dollars (non-GAAP), which is around 260 and 352 percent higher than in the previous year.

-

Sales development (Image: AMD)

Sales development (Image: AMD)

Image 1 of 3

Sales development

Sales development  >

>  P&L (GAAP)

P&L (GAAP) Lisa Su was correspondingly satisfied and still optimistic about the company's key figures in the second quarter of 2021.

Our business performed exceptionally well in the second quarter as revenue and operating margin doubled and profitability more than tripled year-over-year.

We now expect our 2021 annual revenue to grow by approximately 60 percent year-over-year driven by strong execution and increased customer preference for our leadership products.

Dr. Lisa Su, AMD President and CEO

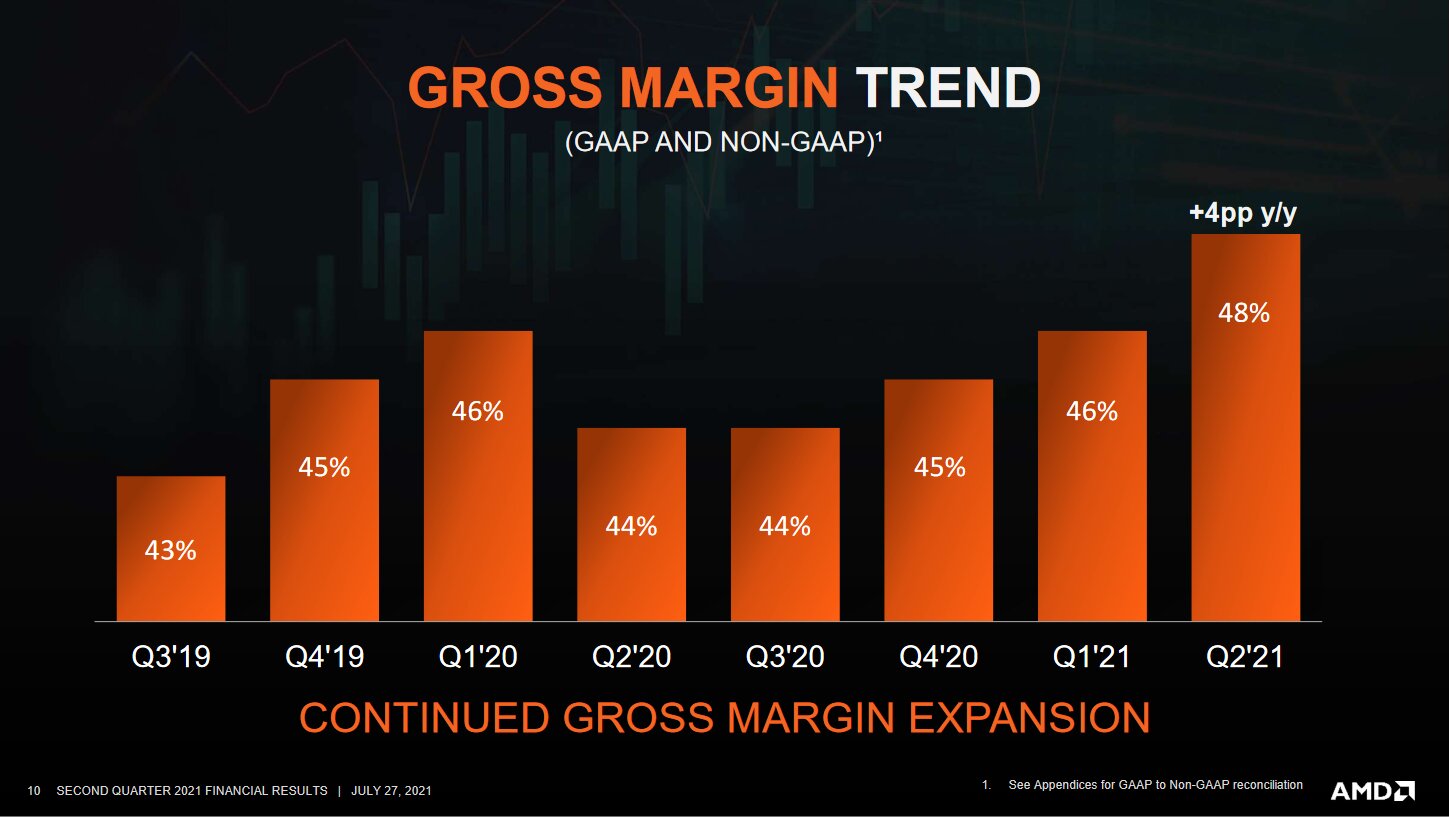

In addition to sales and profit, AMD was also able to increase its gross margin slightly from 47 to 48 percent compared to the previous year. Lisa Su also spoke about the “significantly faster” growth of AMD “compared to the market”.

We are growing significantly faster than the market with strong demand across all of our businesses.

Dr. Lisa Su, AMD President and CEO

Earnings per note rose year-on-year from 0.13 US dollars to 0.58 US dollars per share Compared to the previous quarter (1.45 euros), it is significantly lower.

Ryzen and Radeon as sales guarantees

It is not uncommon for certain sectors and areas to stand out even from a positive overall result, AMD does not go into detail and only speaks of a “mix of sales, including Ryzen, Radeon and Epyc”.

The business figures show mainly Ryzen and Radeon with 2.25 billion sales ahead of Epyc, Embedded and the Semi-Custom area, which is responsible for the custom APU for the Valve Steam Deck, with 1.6 billion US dollars Sales guarantees. All other areas generated an operating loss of $ 93 million.

The graphics cards, which are constantly sold out and still sold well above the RRP, for whose retail price AMD is not responsible, have made their contribution to the positive overall result. The strong Ryzen 5000 (test) were also not insignificantly involved in the sales. For the server division, AMD explains that, for example, more Rome than Milan processors are still being shipped, and that should not change until the second half of the year. The delivery situation for all products will remain tense for the entire year 2021, relaxation is not expected until 2022.

The outlook remains positive

Under these conditions, AMD expects quarterly sales of around 4.1 billion US dollars (+/- 100 million) for Q3/2021 and a further gross profit margin of 48 percent. They hope to be able to meet all demands largely, explained CEO Lisa Su.

In addition, the company expects an increase in sales of around 60 percent for the year, which is based on the previous 9.763 Billion US dollars would mean more than 15.3 billion US dollars in sales this year – a new record in AMD’s 50-year history. Most recently, the company was assuming $ 14.6 billion.

The official presentation (PDF) of the quarterly figures Q2/2021 provides further details and even deeper insights.