Published 21 June 2021 at 17.47

Economics. (ANALYSIS). The Federal Reserve may have reached the end of its road with its policy of stimulating the economy through the banknote press. If that is the case, the fact that the banks return the newly printed money to the central bank is gossiped about, through an event that the media almost completely missed.

Like the article p & aring; Facebook

& copy; & nbsp; St Louis Fed

Can you save the economy by printing more money? If you ask the world's central banks, they have answered yes to that question since the financial crisis in 2007. But now something has happened – in the shadow of the media – that may make them say no.

Last Thursday, US banks and funds parked 756 billion in the central bank's account. This corresponds to approximately SEK 19,700 per American.

It's all about something called the overnight reverse repurchase agreement, or reverse repurchase agreement, which applies from one day to the next. The Swedish term repo rate, which many people recognize, is the interest rate that the Riksbank pays when the Swedish banks deposit their money in this way.

But what is a bank? A bank is a company that lends money that it itself borrows from the central bank, which is the banks' bank and which can create as much money as it wants. In the United States, the central bank is called the Federal Reserve (Fed).

If a bank has borrowed from the Fed and has not been able to lend in turn, it sits nicely with a pile of banknotes. To avoid the interest cost of the surplus, it can, through a reverse scratch, return the money to the Fed.

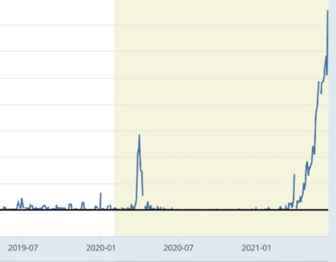

Since the beginning of April, banks have increasingly had to use the repo tool, as can be seen in the chart to the right.

The chart may seem less dramatic than it actually is. Reverse repos are usually used when banks have to balance their accounts quarterly and annually. The rise in 2021, on the other hand, is historically unparalleled.

What, then, does the inflated interest in reverse repurchase among banks and funds mean? The background is that the banknote presses are hot all over the world and steaming fresh banknotes are raining down on the economies. The financial players borrow the money and buy for everything the reins hold.

The task is to invest these on behalf of their shareholders in order to achieve the greatest possible return. They buy interest-bearing securities, shares and the like. The buying pressure is so violent that they cut on everything that moves. They push down the market interest rate to close to 0 percent and the stock market up to new record levels.

What has happened is that the bankers have now bought everything that can be bought. It is visible in black and white because the repo rate that the Fed has been offering the banks since April 16 is only 0.05 percent. In other words, bankers and fund managers cannot find any investment that provides better terms than this.

Furthermore, investors will sooner or later get cold feet. How will they act if they start worrying about the stock market turning downwards? If they think so, they do not want to put the newly printed money there. What do they think if inflation picks up? The latter has already begun little by little. Then they may not want to commit for three or ten years by buying a low-interest treasury bill.

The Fed's attempt to stimulate the economy through banknote presses has come to a halt. We should consider that financial doping has admittedly meant an extremely long-lasting boom, but also that it is artificial. A not too bold assessment is that the world economy at the moment is a bubble that needs to be adjusted, but that it will not happen through a recession, but because the bubble bursts.

It is a bubble where historical comparisons fade.

In principle, the Fed has chosen the path since the financial crisis. They have chosen to postpone the problem to the future. They have provided the banks with horrible sums of cash, they have counteracted the deflation in the gate and they have financially medicated against the coronavirus.

This new crisis, made visible by the demand for reverse scratches, the Fed is now trying to deal with. In a way, this crisis is clearly different from the previous ones, as there is no fire pit that can be extinguished with money, and where Fed firefighters spray the water back at the pump station.

You can think of the banknote press policy as a car that happened in cord. With each crisis, the car gets worse and worse when the Fed tries to steer the road. They are forced to steer harder and harder than here than there. With the numbers over scratches may very well show that the car is already in the ditch. We'll find out soon.

Why has the Fed chosen this path? Every economist knows that there are no free lunches. Perhaps the answer lies in the World Economic Forum's speech on “Great Reset”. Because it will be as they say: You will not own anything and you will learn to be happy anyway. They know that the current system is unsustainable and are preparing as best they can.

But not everything is pitch black. The crash that Klaus Schwab is waiting for, even accelerationists are waiting for. After this day, the unwritten magazine begins where political, economic and cultural changes become possible.

Johan Omark