From one make two, or even more. Siemens CEO Joe Kaeser is the of trading on the longed-for step, and splits the Munich-based industrial group in the two companies.

In September, 2020 to be listed in addition to a whole for the digital age-oriented Siemens AG, a large energy technology group of the stock exchange, which also carries the Siemens name. “We have initiated the largest structural change in the recent history of Siemens in the way,” said Kaeser on Wednesday to investors and analysts. “The question was: How can I create a company that can survive the fourth industrial Revolution?” Both in the future core business with the digitization of factories, buildings and entire cities as well as in the energy division will initially be saved: at Least to 10,400 jobs. Elsewhere, however, more than 20,000 new.

“The spin-off of the ailing power plant business makes sense,” said Daniela Bergdolt, Vice-President of the German protection Association for securities ownership in an interview with DW. It is a new Siemens group from the remaining digital industries emerging. “Now, the group is set up so that Mr Kaeser will be presenting. There will be only strategic enterprises, “which are meshed all together,” Bergdolt.

Stockbrokers are celebrating the decision

Stock market experts celebrated the spin-off. The Siemens shares jumped 4.5 percent. “The realignment as a technology group is sealed,” said portfolio Manager Christoph drizzle of Union Investment told Reuters. Analyst Peter Reilly of Jefferies said it was a “big step in the right direction”. For the first Time, Siemens is able to give in the course of his “fleet strategy” in fact, the majority of a whole area of business, said Gael de-Bray from Deutsche Bank.

At the time of the IPO, Siemens AG will retain nearly 50 percent of the former energy subsidiary, “to set input of a strong signal,” as Kaeser said. The remaining share of the employees ‘ representatives for the time being, “Siemens Power AG” baptized for the society will be distributed to the shareholders. In the long term, Siemens could fall-share up to 25 percent.

Win-win Situation for the shareholders

Shareholder activist Daniela Bergdolt welcomes this approach and sees a kind of “win-win-Situation” for the shareholders: “first, many believe that they will have due to the shares in the new company, you get an increase in value. Secondly, the company believes that Siemens ‘without’ Gas and Power ‘ flexible.” Siemens is now aligned strategically “linear” and no longer counts as “the conglomerate, the Bergdolt everything Possible with with grinds”.

The business with the coal and Gas power plants, but also wind turbines do not consume a lot of capital – but with the margins of most of the other areas. Without the division of Gas & Power and wind power, a subsidiary of Siemens, Gamesa, Siemens chief sees a Chance to screw the return on sales last less than eleven per cent to 14 to 18 percent. In the energy business, the group has so far been used only on four per cent, more than eight percent in the next four years.

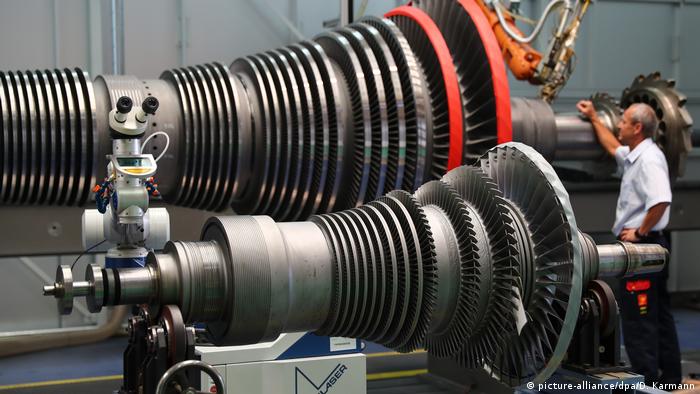

Gas turbine maintenance

Turbine industry is in transition

The industry is in upheaval: In the turbines business, Siemens is building 6000, because after the energy transition, large Gas – and coal-fired power plants are no longer in demand. Siemens, Gamesa is struggling with price pressure. Of a crisis in the division, but could not be the speech, said Kaeser. “If such a crisis look like, I look forward to the next one.” The world need to duration of a lot more electricity for electric cars. “The opportunities are enormous. This will all take, but it will come.”

Siemens disconnects with the energy division of nearly a quarter of its 388.000 employees and one-third of sales. Kaesers predecessor, Peter Löscher, who had dreamed of a 100-billion-Euro-group. After the split-up Siemens on a good half. “Focus creates growth, not size. If size were the solution, would be the world today is full of dinosaurs,” said Kaeser. A year ago he had brought the medical technology division of Siemens Healthineers to the stock exchange.

Unions drag

Despite the impending job cuts and CEO of Siemens has won the trade unionists and workforce representatives, who had walked a year ago against the cuts in the power plant division of a storm. The decision of the Supervisory Board was unanimous. “It is a company that offers in spite of some uncertainties, the better prospects for the employees,” said IG Metall Board member Juergen Kerner. Works Council chief Birgit Steinborn said, the energy sector would be in the case of Siemens “literally starved”.

Against a sale of the power plant division of the Japanese Mitsubishi Hitachi the workers had locked representatives. They insist that the new company has the headquarters in Germany. Where you will actually be managed, but is open. So far, the main headquarters of the Gas – and electricity-based division in Houston, Texas.

Automation and infrastructure division is a future core

As the “industrial core” of Siemens Kaeser sees in the future, the automation and the infrastructure division. But even there, the cuts threaten: Up to 4900 Points in the Digital Industries on the Brink, 3000 in the case of Smart Infrastructure. A majority of the Affected’m just going to retire, said Kaeser. In the administration, he wants to eliminate approximately 2,500 of 12,500. To reduce the cost by 2023 to 2.2 billion euros, but costs a billion. Also, the new energy company goes to the energy-saving rate: Within four years, 500 million euros are to be taken out of the cost, to double the rate of return – how many jobs does that cost, is unclear.

Day-to-day business at least: In the second quarter of Siemens ‘ fiscal year (from January to March) increased the adjusted operating result (Ebita) in the industrial business by seven per cent to 2.41 billion euros, more than anticipated by experts. Sales climbed by four percent to 20.9 billion euros. The order backlog stands at € 142 billion at a record level. And even the energy division improved the result significantly. An increase in the profit forecast for 2018/19 (as of the end of September) chief financial officer Ralf Thomas to wait, but in the third quarter. “The forecast also has an upper half”, he suggested a clarification.