The debt burden in the world, according to the “debt report 2019” dramatic – and rising. Africa is particularly affected by cyclone “Idai” the situation has become worse for some States in the South.

As a cyclone Idai swept in Mozambique, he met a country on the ground. Mozambique is groaning for years under a mountain of debt in the billions – money that should be available to respond to the current disaster. This 1.85 million people are affected: Many tracts of land are under water in the affected areas, a Cholera epidemic is looming. Also in the highly indebted neighboring countries of Zimbabwe and Malawi, the situation is serious. “The Situation is really dramatic,” says Klaus Schilder from the Catholic relief organization Misereor. For Mozambique, it calls for a debt moratorium, in the medium term, a debt had to be cut tested. “That would be an excellent opportunity for the country in emergency situation additional leeway to give,” says shields.

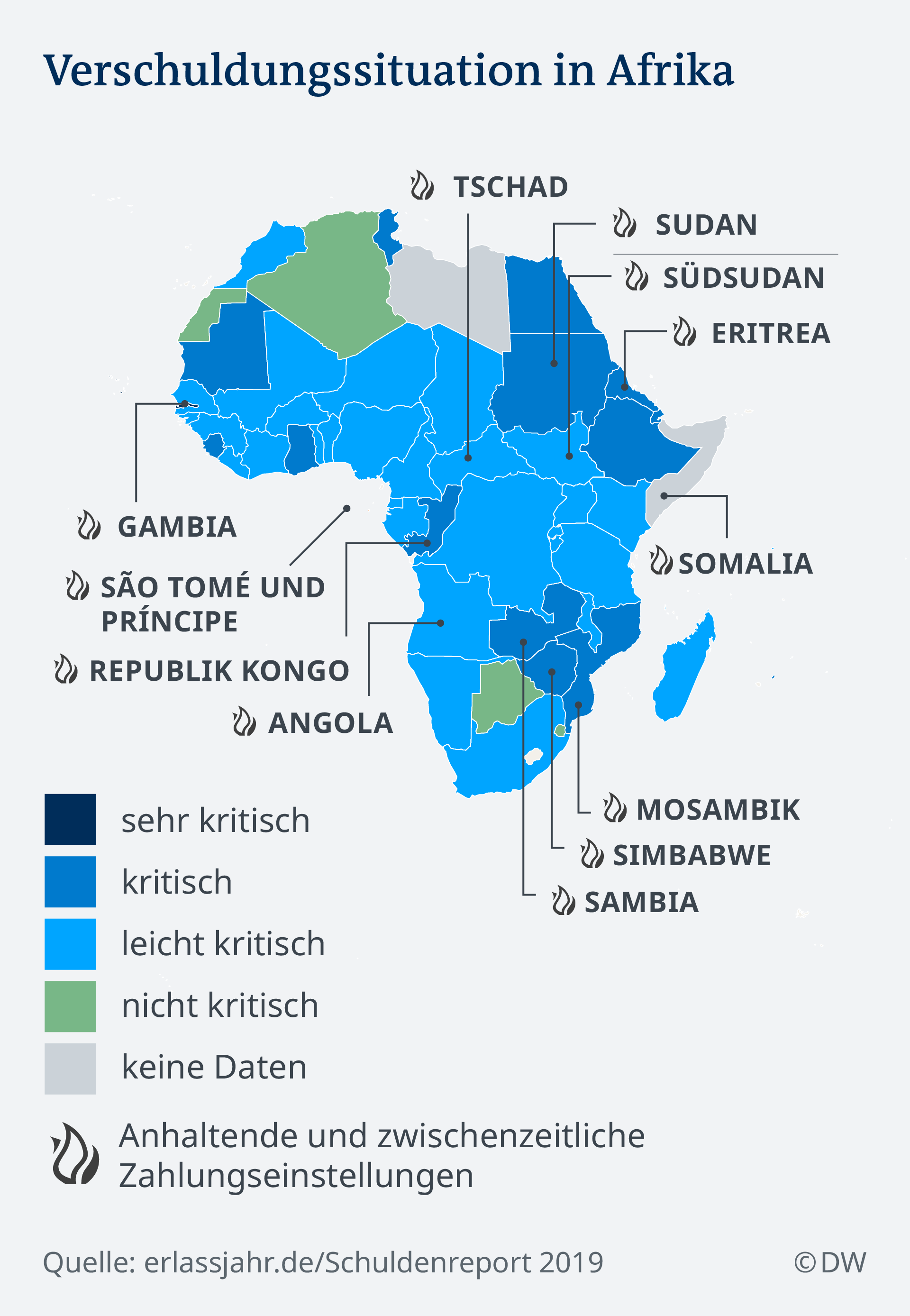

According to the “debt report 2019” of the Association erlassjahr.de the situation is dramatically worldwide. The Alliance of churches and non-governmental organizations presented the debt-to-report, together with Misereor in Berlin. Of the 154 countries studied, 122 are in debt critical – three more than last year. “It is a dramatically high level of over-Indebtedness,” said Jürgen Kaiser of erlassjahr.de. Threat, the Situation is not only in Africa, Asian countries, such as Mongolia and Bhutan are concerned, Bahrain and Lebanon in the Middle East are in a critical situation. “Africa is most affected almost all countries. There is little grey spots on our Africa map”, so the Emperor to the DW.

Five African countries have set for 2015, payments: Gambia, Angola, Sudan, and São Tomé and Príncipe. Also Eritrea, Somalia and Sudan do not pay their debts. In Mozambique and in the Republic of the Congo political failure was the reason, because the governments secretly billion in loans. In many other countries a different phenomenon is, according to the Emperor, but responsible for the crisis: in view of low global interest rates, loans become cheaper. Countries in the South to borrow, therefore, more and more money to their infrastructure – such as roads, Railways, and airports. Foreign governments and institutions such as the world Bank is heating up from the point of view of the authors of the debt report the debt by issuing loans.

‘China is not the bad guy’

An important Player in Africa is China. Between 2000 and 2017, the country and the African States and enterprises granted loans in the amount of EUR 143 billion. But: “China is not the bad guy”, so the adoption year.de-coordinator of the Kaiser. It is African countries have adopted in a big way in the past debts. The authors of the fault reports, the world Bank and European development initiatives for the debt problem mitveran word: “initiatives such as the ‘Compact with Africa’, which emerged during the German presidency of the G20, bergen, depending on the financing modalities have been chosen, a high debt risk,” says Misereor expert signs. Currently, the Federal government is planning a new investment Fund of one billion euros to provide loans for investment in Africa.

According to experts, China is not alone for the debt crisis

While formed in a number of African countries, civil society Initiatives, do not seem to have recognized many of the governments of the seriousness of the situation. “It really took a lot of apologetic position, where governments have very brusquely that it is on the way to a new debt crisis,” says Kaiser. The would suffer its own citizens – such as in Mozambique, where the government was lacking even before the cyclone, Idai, the money for schools or hospitals. Millions of people are already being affected: “If a large proportion of the financial flows of a country in the debt service, it is made by the government is impossible, the necessary funds for health or education,” says Misereor representative signs.

The creators of the debt reports therefore call for a global debt registry. The debt of all countries should be publicly available, including repayment arrangements, creditor, and incidental costs. In addition, erlassjahr.de for an internationally valid insolvency proceedings: the Highly indebted countries should be relieved of their debts in an orderly way, without the population have to indirectly bear the costs. But that is not likely as soon as come: initiatives for such a procedure there for almost 20 years.