The scope of Chinese investment and Acquisitions in Europe. The reasons for this lie in China as in Europe. The continuing growth in China seems to be over and in Europe it is become more sceptical.

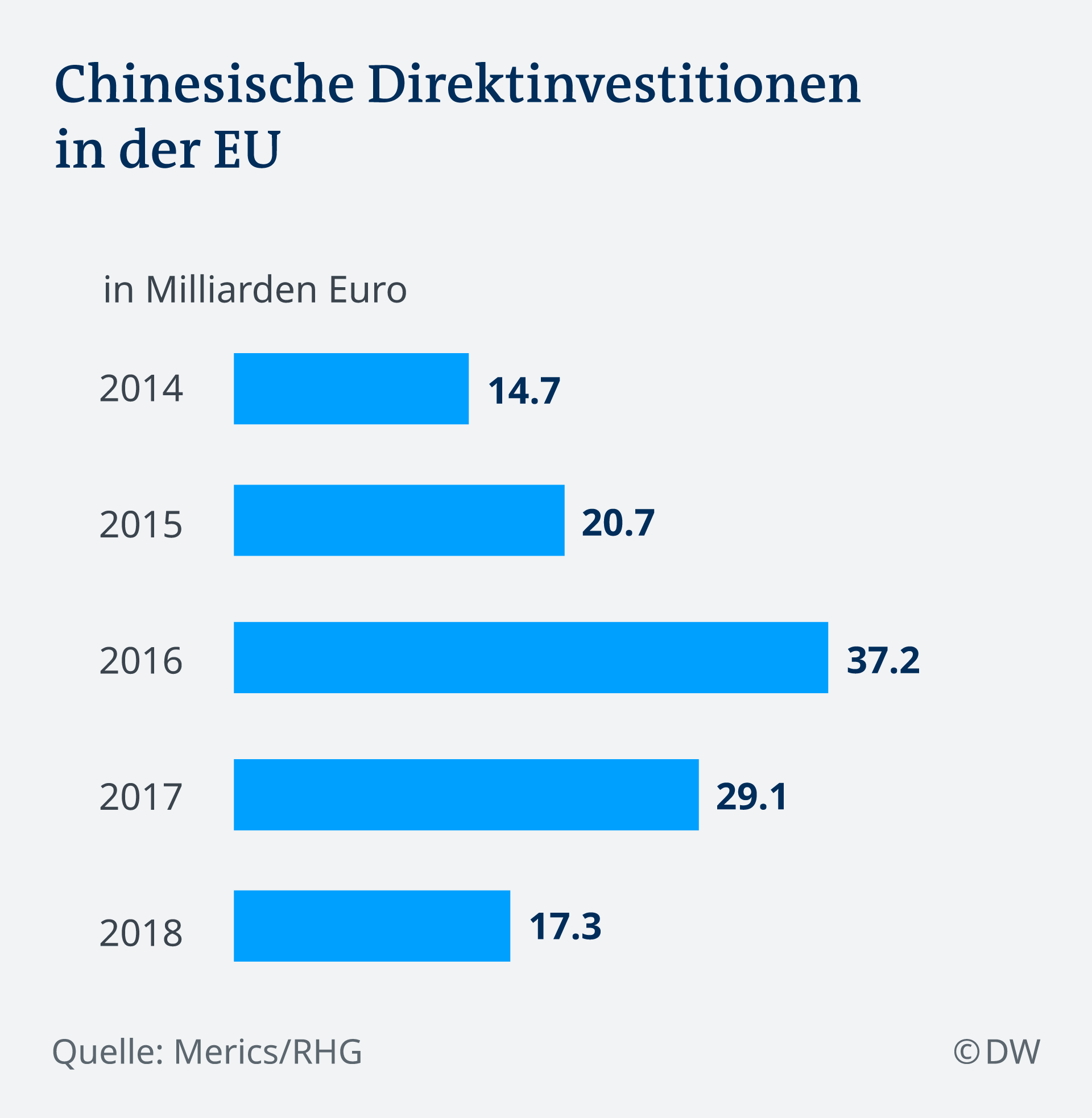

The drop is considerable: Chinese companies have taken in the past year, significantly less money for Acquisitions in Europe in the Hand than in the previous years. To 40% in 2018, China’s decreased direct investment in the 28 countries of the EU. They still stood at 17.3 billion euros. The present study of the Berlin Merics Institute and the U.S. consulting firm Rhodium Group.

In total, the Acquisitions have the lowest value since 2014. The highlight of the Chinese direct investment in the EU fell by 37 billion euros in the year 2016.

An important reason for the decline, among other things, stricter capital controls in China are the authors of the study estimated that. So that’ll be it for Chinese enterprises difficult to transfer money abroad. It should also be observed in the country with a General shortage of liquidity.

Big four

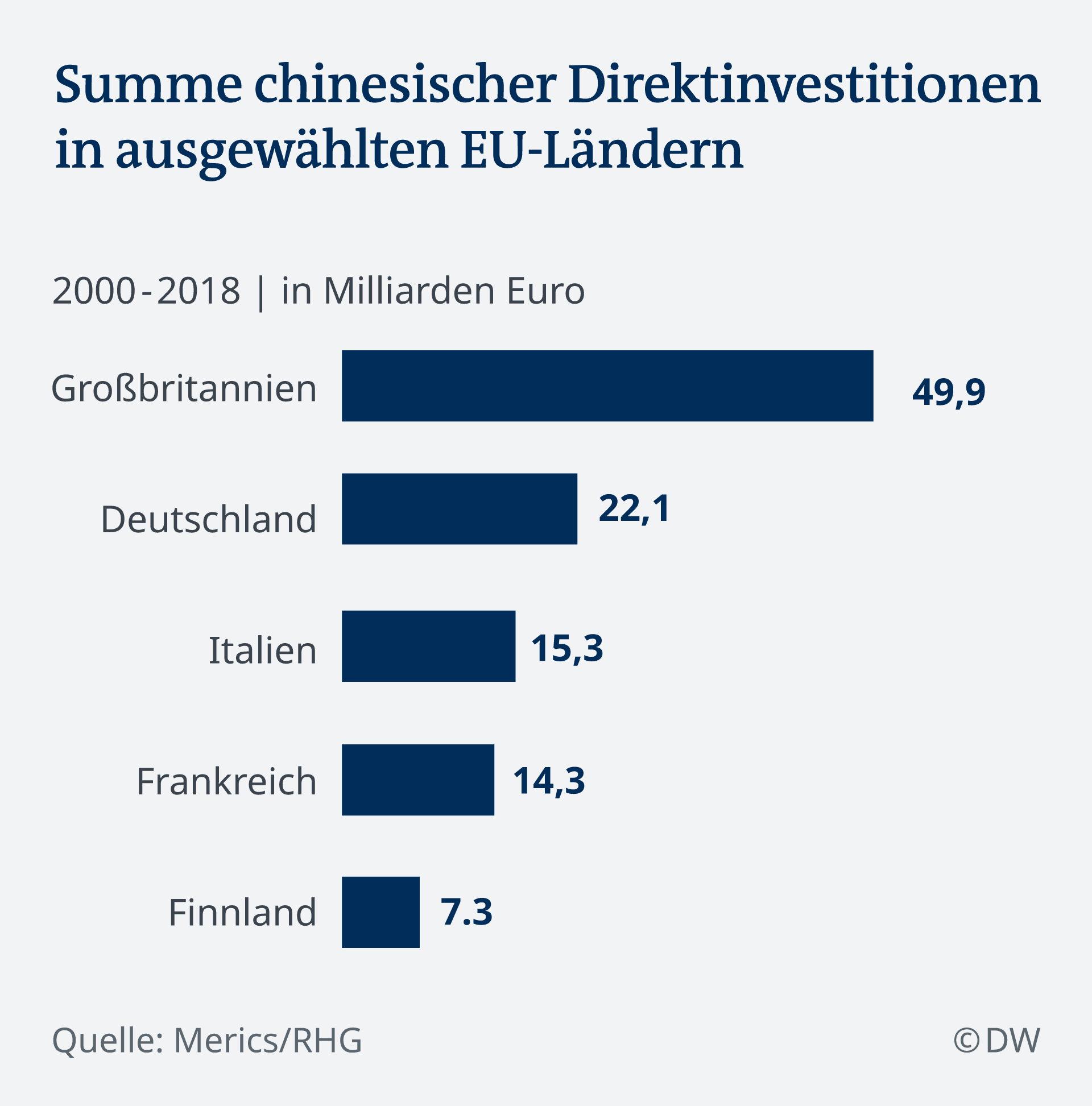

The lion’s share of the commitment of Chinese companies in Europe, distributed to a few countries. In the years 2000 to 2018 flowed by far the largest amount of direct investment of almost 50 billion euros to the UK. It is Germany – with more than 22 billion euros – as well as Italy and France.

To was similar assessments of Chinese investment in Europe a few weeks ago, the consulting firm EY has come. EY used slightly different criteria and has also extended to European countries outside the EU. After that, in 2018, Europe shrank far, the volume of investments from China within a year to almost half.

The number of acquisitions or investments in Germany alone declined in the past year to 35. Chinese investors were here 2016 68 Times, have become active, 2017 54 Times. For special attention in the period the commitment of the Chinese Geely Group, the German car maker Daimler in the amount of the estimated 8.9 billion dollars. Even if it was by far the biggest investment in a German company, it does not apply to international criteria, but as a direct investment. A Takeover of at least ten percent of a company is necessary. This was not the case of Daimler.

Changing The Rules Of The Game

Also, EY stated in its own analysis, one of the reasons for the decline in investment activity had altered the framework conditions in China: “The government wants to prevent excessive capital outflows, and wishes to have a concentration of investment activities in core industry sectors,” EY-China expert Yi Sun.

For both institutions, stricter rules in Europe to play a role, the more Chinese Takeovers. This would have prevented investments will be delayed or even. It is expected that these controls continue to be tightened, write the authors of the Merics study Thilo Hanemann, Agatha Scratch, and Mikko Huotari.

In 2016, caused a stir: the Acquisition of the German robot manufacturer Kuka

The growing concern of the Federal government investment in sensitive technology areas, and critical infrastructure would have led to delays or even to Failure of contract negotiations with Chinese investors. Examples: the German machine manufacturer Leifeld and the electricity grid operator 50Hertz.

Problem or opportunity?

The trade should calm down a conflict between the United States and China, and the Chinese economy, re-tighten, will grow according to estimates by the consultant of EY, the willingness to invest in Chinese companies. “German machine manufacturers and High-Tech companies remain for Chinese investors as attractive, such as companies from the fields of health and medical technology,” – said in their study.

Conversely, the professionals of Merics and Rhodium Group expect that Europe will remain a more attractive location for Chinese investors, if the trade conflict between the United States and China continues to smoulder. Instead of America, Chinese companies could then put at Acquisitions, possibly even more strongly on Europe.

ar/dk (dpa, afp, Merics/MRL, EY)