The International monetary Fund was for countries in Need, and always as a last resort and lifeline. But the conditions of the IMF-linked funds, still large Controversy.

After the Second world war, the International monetary Fund (IMF) was launched. He should allow countries with payment difficulties, to borrow temporarily money and so your debts with other creditors to reduce. That should restore financial stability, and global cooperation to promote, facilitate trade, and thereby growth. Poverty also should reduce the IMF.

More than 74 years after its founding, critics and proponents debate is still about the methods that the IMF uses to achieve its objectives. Proponents of the IMF recovery programs to say, that the liquidity prevented a larger financial Hardship of the affected countries. In addition, these reforms would need to implement in order to be more competitive.

The opponents, however, are of the opinion that the non-performing countries will be more dependent on the help of the IMF and its citizens even poorer. “The programs of the IMF, will drive a large wedge between the social risk borne by the troubled country – and the private risk borne by the banks,” brought with it the 2017 deceased Economist Allan Meltzer of Carnegie Mellon University, once to the point.

More: emerging economies in the Wake of the Turkey-crisis

IMF Chief Christine Lagarde (here in July at the G20 Meeting in Buenos Aires) is convinced that austerity measures with financial rescue packages must go hand-in-hand, weak economies for global competition make it fit

The Washington consensus

The programs of the IMF were considered in particular in the early years as quite successful. Mohsin S. Khan, IMF Director for the Middle East and Central Asia, has about investigated the rescue of 69 developing countries over the period from 1973 to 1988. However, he noted that the short – term and long-term impact of the programs by the IMF were mainly positive for the current account balance of the countries, their balance of payments and inflation rate. Among those who were classified as “success stories of the IMF,” were both credit programs for Mexico in the 1980s, as well as those for India and Kenya.

Despite this positive assessment, the IMF changed its policy in the 1990s. The Reform was known as the “Washington consensus”: because the IMF called for more effective structural reforms. He wanted to strengthen the role of market forces in exchange for immediate financial assistance.

For the first time by the British Economist John Williamson in 1989, determined, belonged to the principles of reduced borrowing by the state. This should prevent large budget deficits. The countries had to cut subsidies and corporate taxes lower. Other recommended “structural adjustments” were: free exchange rates, a policy of free trade, an easing of rules for foreign direct investment and the privatisation of state-owned companies.

This by critics as a “neo-liberal economic policy called” Washington consensus, has since become one of the cornerstones of the conditions for rescue packages. Not only the IMF but also the world Bank a request by the recipient countries.

More: emerging new crisis?

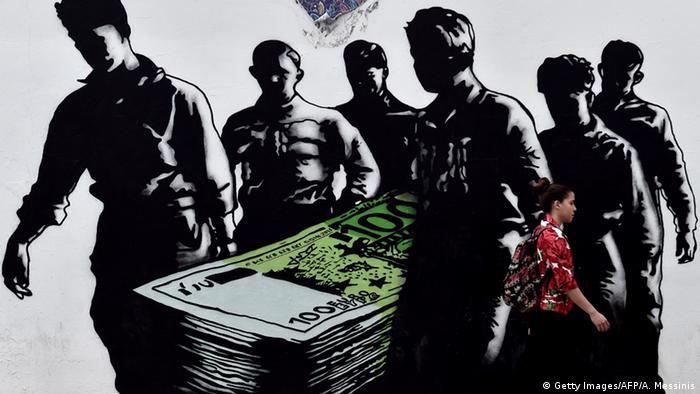

During the Greek debt crisis, the IMF became the favourite hate object of many people

A model for all

Joseph Stiglitz, chief economist of the world Bank between 1997 and 2000, had, however, serious doubts as to the feasibility of the new doctrine. Although he noted at the time that this policy was for some Latin American countries, he said: “It makes no sense to apply it completely flat in other countries.”

Stiglitz was also of the opinion that the interests of the taxpayer were not taken into account, although the IMF was equipped with their money. There is no parliamentary control by the member States.

In 1995, Mexico was regarded as a flagship example of the new policy of the IMF: It is to be paid to a rescue package in the amount of the equivalent of 45 billion euros. But just a few years later, the downsides of this policy occurred.

The citizens of Mexico suffered a sharp decline in their real Per capita income: in 1998 it fell to a level last seen in 1974.

In addition, debt added between the end of 1994 and the end of 1996, Mexico’s total foreign other 560 billion US dollars, because the government saved mainly commercial banks and its bad loans had been transferred.

Some Economists see the rescue packages in Latin America, even as the origin of the financial crisis in Asia in the late 1990s. They say the International monetary Fund have given to the world originally is a clear Signal that the lenders, the investors come to help if something is going wrong.

Read more: BRICS to 2018: South Africa as a clock in the emerging countries

Asia-crisis

The Asian financial crisis of the late 1990s was caused in large Parts by the strong dependence of South Korea, Thailand, Malaysia, Indonesia and the Philippines of short-term foreign loans. Your run took the crisis in 1997, It was visible that many companies would not be able to meet their payment obligations. The international financial markets panicked, and the Asian currencies plummeted dramatically.

The International monetary Fund treated the Asian “meltdown” as with other emergency situations, and helped only in exchange for structural adjustment measures. He instructed governments to cut their spending. The result: The economic downturn intensified.

In South Korea, for example, a country with an income level, the European Standards, close to, shot the unemployment rate of about three to ten percent. So-called “IMF suicides” were common among the workers who had lost their Job and thus their Dignity.

Indonesia was the worst hit. The poverty rate rose from an official level of eleven percent before the crisis to 40 – 60 percent. The gross domestic product fell by 15 percent within a year.

Malaysia, however, made it different: The country rejected aid and advice of the IMF. To open instead of active in your economy sought to Malaysia, to prevent speculation in the currency and imposed capital controls. The International monetary Fund criticized this approach from the beginning, he had to admit later that the measures were successful.

For the last two decades Argentina is in permanent crisis mode. While the Ex-President Cristina Kirchner has tried to the debt crisis is to simply sit out by you to repay refused loans, the current President, Mauricio Macri, to negotiate with the creditors of the country.

The sovereign debt crisis in the Euro zone

A few years later – from about 2010 began, the sovereign debt crisis in the Eurozone. Now the independent regulatory body of the IMF to the stand, the approach of the International monetary Fund is very critical. “To tell optimistic before that prevented to detect the extent of the problem,” wrote the Independent evaluation office (IEO), in a report from the year 2016. The impression was created that “the IMF, Europe is treated differently”.

The crisis that began in Greece and Ireland, Portugal, Spain and Cyprus exceeded, the common currency, the then-19 Eurozone countries under extreme pressure. Speculators bet on the end of the European common currency.

Despite rescue packages out of a total 298 billion euros, the unemployment remains, such as in Greece, with a Rate of 22.5 per cent, stubbornly high. There, the minimum wage of 863 euros fell to 684 euros. The government has halved the expenditure on health almost. But Greece’s lenders are demanding that Athens spends less than it takes to generate the necessary Surpluses to the repayment of its debt.

Déjà-vu

In the past few months, it seems that more and more officials from ministries of Finance from around the world met with representatives of the IMF in Washington. At the same time money flows more and more from emerging countries, and and is created in the United States. In the result, the value of the US rising dollar and the currencies of the emerging countries, falling partly through the Floor. Your debts are primarily denominated in dollars, have now become a high load.

Turkey controls as on a precipice, like many other countries, including Argentina, Hungary, Egypt, Angola, the Ukraine and Indonesia. They are all affected, since investors from risk, emerging countries richer-stocks and bonds separate, and prefer to be in seemingly safe American assets to invest.

The Argentine economic Minister in Washington, a hastily revised loan agreement with the IMF to negotiate. It comes to strengthen the confidence of investors in the Peso, which had recently lost much of their value.

The IMF is confident that the austerity measures adopted by the government in Buenos Aires, the work of down in the opposite trend. Including the reduction of energy subsidies and the loss of 95,000 jobs in the public sector.

Turkey is trying, however, to survive the storm that came over the threshold countries. The value of the Lira has fallen drastically. Ankara refuses to date, to ask the IMF for a rescue. It will let “the population is only more suffering,” from the government.