Japan

Japan’s protracted crisis

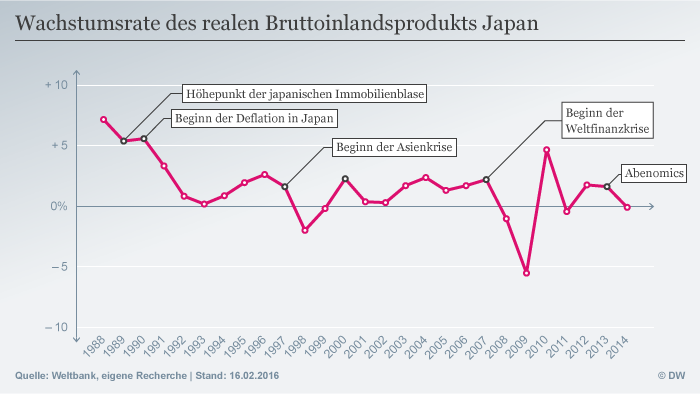

For 25 years, is fighting Japan’s economy with Stagnation. All actions of the governments had at best a short-term effect. Without structural reforms, it is also the world economy is threatened.

The Japanese gross domestic product fell from October to December 2015 on an annualised basis by 1.4 percent, as the government in Tokyo on Monday (15.02.2016) announced. The Numbers were slightly worse than feared. Experts had, with a decrease of 1.2 per cent is expected. Hanns Günther Hilpert, Japanfachmann of the science and politics Foundation in Berlin, says in an interview with the German wave.”This is likely the people of Japan in their attitude confirmed: It is just not better.”

If you ask the Japanese themselves, after the economic future of their country, then there is in many Parts of the society Resignation. From end of the 1980er years was in Japan a massive real estate and equity bubble created by low interest rate policy of the government in Tokyo still fired. As the bubble burst, many households are hugely indebted. Also Japan’s banks were used by the Abwärtssog recorded. Hilpert says: “this crisis has Japan never really recovered.”

Container terminal in Tokyo

Countermeasures of the government

Since the crisis is the domestic consumption is low. Go, therefore it is in the core, so Hilpert: “The main problem is the lack of private demand.” The great Depression remained, however, because the state is the reversal of demand in your own country with economic stimulus packages compensated.

Further shocks such as the Asian crisis in 1997 or the global financial crisis in 2007 put the Japanese economy. The recipe was always the same: More fiscal measures of the state. The national debt has pushed up. It was 2015 for astronomical 245 percent of gross domestic product.

In 2012 came the present Prime Minister Shinzo Abe to Power. His liberal democratic party decided 2013 comprehensive measures to revive the economy, under the heading “Abenomics” became known world-wide. The Abenomics have three main thrusts: A monetary policy, a fiscal and a structural. Since 2013 increases the Japanese Central Bank’s massive volume of money. The hoped-for increase in the inflation rate, the more consumption of animate, however, have remained until today. Fiskalpolitisch were stimulus programs launched, however, because of the already high public debt, these had soon moved back again. Klaus-Jürgen Gern, from the Institute for world economy in Kiel, Germany, concluded: “The fiscal policy was only a temporary syringe.”

Structural reforms remain

The third pillar of Abenomics relies on structural reforms. This, however, hardly come forward. In it, experts Hilpert and Happy to agree. This can be, for example, the labour market show: Japan has officially deregulated labour market, in fact, but this is true only in part. On the one hand, there are well-paid, permanent jobs in large companies, on the other hand, precarious working conditions, especially in the small – and medium-sized business. The number of people in insecure, poorly paid Jobs since the 90s has increased continuously, especially among young people. This has the consequence that a growing proportion of society with Concerns in the future, which, in turn, their consumer spending inhibits. “It would have reforms in the labour market be carried out, and indeed against the will of the corporations, and the economy,” says Hilpert and is convinced that “This would be the Konsumquote stabilize.”

Japan’s Nikkei broke last week, nod a

However, exactly failed to appear, as well Like by the Kiel Institute for the world economy States: “In structural reform, the government has not done it, the node to pierce through.” It fails because of the resistance from the economy in which it is traditionally strong areas that are protected, for example in agriculture, but also in employment contracts in large corporations.

Happy to see no signs for improvement: “A Change of this state is not clear. In the Opposition, there is no strong movement for an Alternative show. Abe is still very popular.” This is for Like clear: “The potential growth of the Japanese economy is expected to remain for the foreseeable future hardly above zero.”

The time is running out

Both fiscal and monetary measures of the Abenomics to the government in time gives, but it is not sufficient. Hilpert says: “Japan has tried, the problems with fiscal and monetary policy to cover up. The painful, but necessary reforms, but inevitable.”

The high public debts, the Japanese government more and more leeway. It is not quite as dramatic as in the case of Greece, since it is a public debt in Yen in the domestic. The interest rates on bonds are therefore not yet skyrocketed. But: “It is possible that there is a sovereign debt crisis comes when the credibility of fiscal policy suffers,” says Hilpert. Then could Japan have many years of accumulated and unresolved problems with the whole force meetings.

Japan’s Prime Minister Shinzo Abe

Risk Abwertungswettlauf

The entire development also bears risks for the Rest of the world. Japan is still the third largest economy in the world. Hilpert says: “Abenomics are in Essence a Abwertungsprojekt have been.” The government has the Yen weakened to advantage on the global market to enhance its performance to enable it. Basically, this is a strategy to be at the expense of other States to renovate. But so far, it has Japan, is hardly something, as the last have also the Euro and the Chinese Yuan lost value. In the worst case, there could be a heightened Abwertungswettlauf come, triggered by Japan. “If there is a loss of control, or if the people in charge in Japan is no longer a solution.” This would make the already large money supply increases further, a correction, as it is in the financial crisis of 2007 has once been, could result.