Mobile payment apps let you send money to

anyone using nothing but your phone. Most banks include money-sending

capabilities already, but what makes dedicated mobile payment apps different is

that you don’t need to open a full-fledged bank account to use them. Plus, you

might already have the app on your phone!

Most payment apps for Android and iOS can be

set up in seconds because they just need your debit card number. Others might

use your bank routing number and account number, but either way, you have full

control of which of your banks get used for sending and receiving money.

Best of all, each of these apps are 100% free

for most of the features, and nearly all have zero fees. There are a few

limitations with each service, but they aren’t large enough to stop most people

from using them.

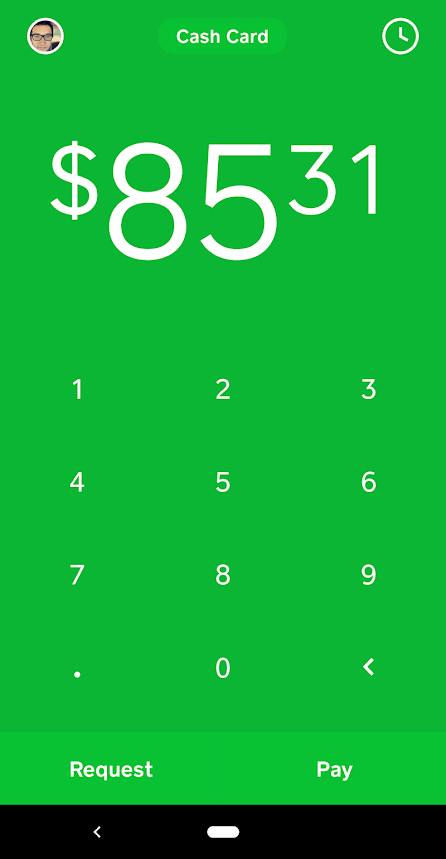

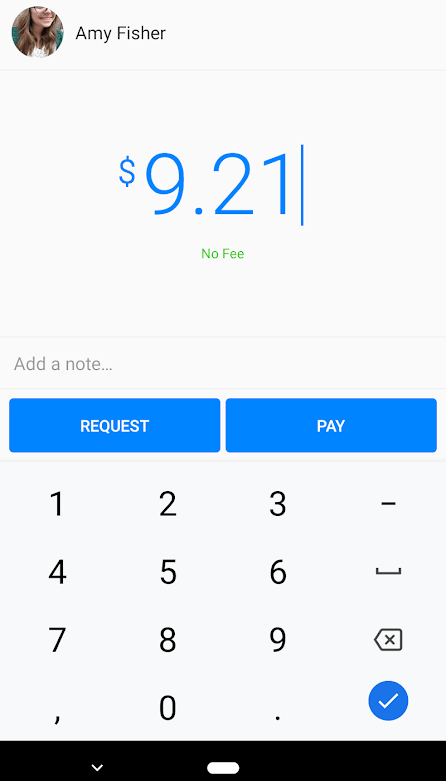

Cash App

Cash App is one of the easier-to-use free money transfer apps. Just add your debit card to your account to send people money in seconds, and it will show up in their account immediately. It’s just as easy to request money, too.

Something really neat about Cash App is that

you get a unique username, called a $Cashtag, that anyone with the app can use

to send you money. You’ll even get your own unique website (more of a simple

profile) where users can visit from a computer and send money directly to you

without disclosing any of your personal information.

Once you have money in your Cash App account,

you can keep it there and use it free with the included debit card, which is

also free and even supports cash-back features. Or, you can transfer your Cash

App funds to your own bank via the account/routing number.

You’re also able to buy Bitcoin with Cash App.

The weekly Bitcoin purchase limit is $10,000, and while that might be a stretch

for most people, it’s nice to know the option is there should you get the

crypto itch.

Cash

App Limits:

- Within seven days: $250, after

which you must verify your social security number and other personal

information to raise the limit to $2,500 /week - Weekly cash-outs: $25,000

- ATM withdrawals: $250

/transaction, $250 /24 hours, $1,000 /week, and $1,250 /month - Fee (based on amount) when

withdrawing instantly to bank; no fee for standard withdrawals that take a few

days

You can use Cash App from their website or via the Android or iOS app.

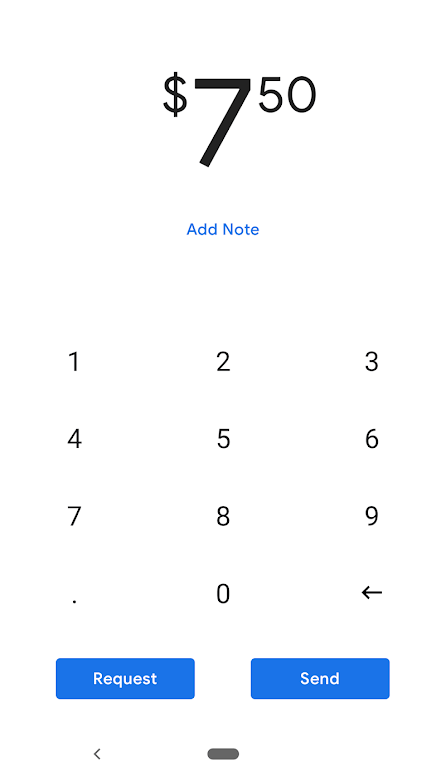

Google Pay

Google Pay is Google’s attempt at the mobile payment market, and they’ve done a decent job. The service used to offer a debit card but currently only works online from the website or app, but it has really high limits if you plan on using it for large payments.

Something we like about Google Pay is that it

can hold cash in your Google account so that you can decide how much money to

disperse to your bank accounts, if you have multiple. Or, you can choose a

default account so that any money sent to you goes into your bank immediately

(and it usually is immediately).

When you go to make a new payment to someone,

either by selecting the contact or entering their email/phone, you have full

control over which account the money comes out of: a bank, debit card, or your

Google Pay balance. You can also add a memo to the transaction for easier

record keeping.

You can send and request money through Google

Pay, and even sign up for reminders to get alerted when it’s time to

send/request money again (like for rent, work, etc.).

Google

Pay Limits:

- Single transaction: Up to $10,000

- Within seven days: Up to $10,00

- Florida residents: Up to $3,000

every 24 hours - Transactions over $2,500:

Recipient must add a bank account to get the money

Google Pay can be used online in a web browser or from an Android or iOS mobile device.

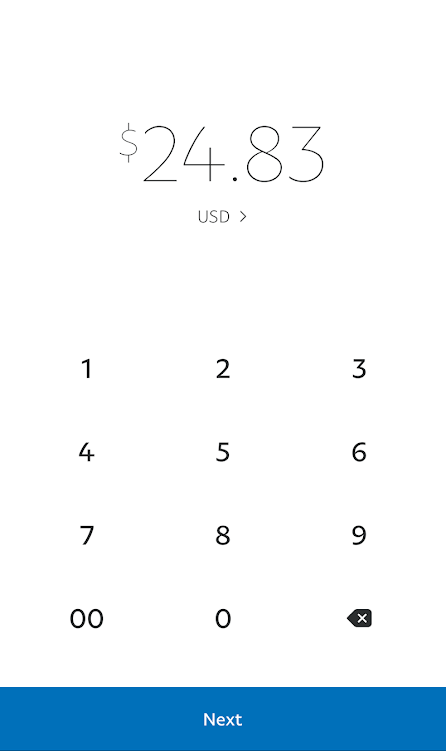

PayPal

PayPal has been around a long time, but it’s still one of the better mobile payment apps you can download. It lets you send money all around the world, and much like Cash App, also lets you get a free PayPal debit card.

Unfortunately, the fees are a bit confusing to understand, so it’s important to read through them thoroughly. Most people, though, who trade for personal reasons should have no problem using PayPal absolutely free.

Like Cash App, you can get a PayPal.me address

PayPal users can visit to easily send you money. PayPal accounts are also

assigned a unique QR code; share it to have others send money to you easily by

just scanning your code, or scan theirs to send the money.

PayPal

Limits:

- Single transaction: 2.9% fee if sending or receiving money with a credit or debit card (no fee for bank accounts)

- Instant debit card withdrawal: $5,000 /transaction, /day, and /week; $15,000 /month

- There are other PayPal fees to consider

Use PayPal online or from the mobile app: iOS or Android.

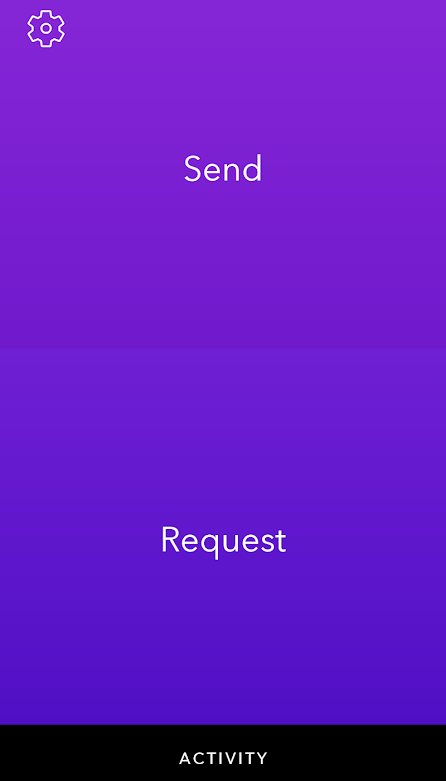

Zelle

Zelle is by far the simplest app in this list. When it’s all said and done, it’s a true bank-to-bank transfer app. Unlike the apps already mentioned, there isn’t a place within your Zelle account where money gets held up until you move it again. In other words, when someone sends you money, it goes right into your bank of choice…usually in seconds!

After downloading the app, you must tie your

phone number to a debit card number, and from there you can send money to or

request money from anyone. If they don’t yet have Zelle, they can add their

debit card to the app to accept your transfer or send money to you; there’s a

14-day grace period for cases like this.

The Zelle service is already built-in to some

banking apps, but if your bank doesn’t support it, then the app is the only way

you can use it, and it’s super easy

to use. The screenshot above is enough to understand just how basic this app

really is.

One side note is that you can, if you so

choose, set up two Zelle accounts: one using your email address that’s tied to

your Zelle-enabled bank, and another with your phone number through the Zelle

app. If you have multiple bank accounts that you like to move money between,

Zelle will work as your own free wire transferring service!

Zelle

Limits:

- $500 within a seven day period if

your bank doesn’t support Zelle

You can get Zelle for Android and iOS.

Facebook Messenger

Most people already have Messenger installed on their phone or open in their browser, so sending money over Facebook’s messaging service might be the easiest way yet. You don’t even need to pull out your bank information!

To do this, tie your debit card or PayPal account to your Facebook account, and then open a new message with the person you want to send money to or request money from.

From a computer, click the money symbol in the

toolbar, type an amount in the Pay

or Request section, and immediately

exchange money right there while texting. From a phone, use the Pay Friend mini app from Messenger’s

slide-out apps menu.

Messenger

Limits:

- Works only for users in France,

the US, and the UK - You can only send money to people

living in the same country as you - Sending money via PayPal is

available only in the US

Using Messenger to get or send money from friends can be done through a browser on a computer or with the Android or iOS app.

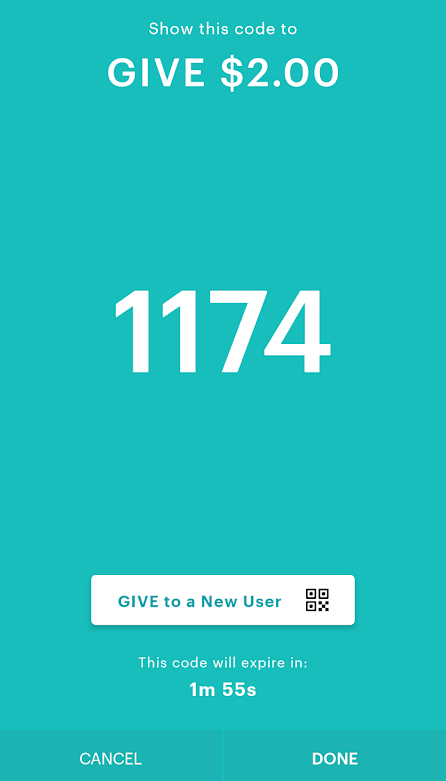

Mezu

Mezu is a unique money-sending app because it’s completely anonymous, lets you send money to anywhere no matter where they live, and even includes a game where you can make money (albeit normally small amounts).

Here’s how it works: enter how much money you

want to send to have the app generate a temporary code, and then share the code

with someone before the time runs out for the money to transfer to their

account instantly. No personal details are shared, and you can send quite a bit

before reaching limits.

You can also request money from people, send

money to contacts (no code required, but it’s not anonymous), and even create

location-based deposits where anyone in the vicinity can drop money into your

account without you having to share codes.

A few times a week, Mezu hosts a game called

Mezu Money Time. After listening to an ad for a couple minutes, you compete

with other players to see who can enter the given code the fastest. Every game

is different but usually, the fastest players are awarded some money, often

anything from $2 to $20.

Mezu

Limits:

- Within seven days: $2,999.99

- Single transaction: $499.99

anonymously - Single transaction: $1,999.99 with

a contact - Withdrawal: $2,999.99 for any

single withdrawal

The Mezu service runs on mobile devices only, both iOS and Android.