The days of agonizing over equations in your

Excel spreadsheet budget are over. It’s 2019, and it’s time to put your money

where your app is. Here, you’ll learn about three financial apps you can

leverage to get your expense tracking, budgeting or both under control:

- Clarity

- EveryDollar

- Mint

But first, maybe you’re wondering why these

apps are useful and what makes them more applicable today than traditional

methods.

Why Go Digital

According to ABA Banking Journal, two-thirds of Americans prefer digital banking channels to traditional channels (e.g., bank branches, ATMs). In our digital age, keeping track of cash and paper records like bills and receipts is probably feels less natural and more burdensome to modern consumers.

If you’re going to use your credit card to

purchase goods on Amazon or even from the brick-and-mortar neighborhood store

down the street; if you’re going set up automatic bill payments through your

banking provider’s web or mobile app–doesn’t it make sense to also budget and

track expenses with a digital tool?

It does! And there are several free and

subscription-based apps available that codify the knowledge and manual work of

budgeting and expense tracking tasks so you can accomplish them with

ease–including Clarity, EveryDollar and Mint.

But as with any digitized service offering

today, there are some things you should consider when choosing the technology

you use to manage your finances, because each app has its own strengths and

weaknesses. Let’s look at what each of the apps we’re discussing brings to the

table.

Clarity – For Web and Mobile

Provider: Goldman Sachs

Cost: Free

Maybe you already have a good grasp of what your regular expenses are; you commit a standard amount to savings each month; you know not to spend over a certain amount of your income before your next paycheck, ensuring you’re prepared for the unexpected.

By all standards, you may not need a budget. What you do need is a way to track your expenses. Here’s where an app like Clarity comes in.

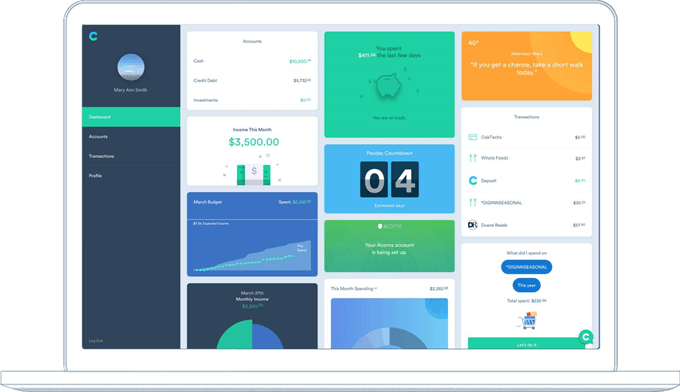

Acquired by Goldman Sachs in 2018, Clarity

offers you an advanced way to manage your multiple bank accounts, bills and

other transactions in one place, giving you a single pane of glass through

which you can view your financial history as well as see where and how your

money is moving as it enters and leaves your accounts. Here’s the kind of clarity

it provides:

- An overview of your financial status, including cash, credit debt and investments

- How much you’ve spent in the last few days

- Recent income flow

- How much you have saved in your Marcus account from Goldman Sachs

- How many days until you get paid

- A monthly budget (unadjustable; more of an overview to help you plan ahead)

- An interactive feature to explore where and how you’re spending money

- Graphs and charts to visualize your financial data

- Recurring expenses to help you understand where your money is going

- The ability to cancel subscriptions or services you pay for

- Free credit score! (Always a nice extra)

- An overview of all your linked credit cards

You can dig deeper into most if not all these

features to get a more detailed perspective of your finances and do some

serious expense tracking.

With so many features and functions, Clarity

will require some time and effort to understand the information the app

provides. But when compared with gathering all this information manually from

across multiple sources, it greatly reduces the time required.

That’s all great. So, what’s the downside?

It’s almost as if Clarity’s strength is its weakness: information overload. While the Clarity dashboard is thorough, it can be a lot to take in, which takes some getting used to.

Due to the amount of information displayed in several charts and graphs or contained in several widgets–all in one place–it’s inevitable you’ll end up homing in on three or four specific sections of the dashboard and neglecting the rest.

Another unfortunate issue that seems to occur with Clarity is the delay in information streaming between your bank accounts and the app. Overall, it does a decent job keeping track of finances and displaying the correct cash flows, but there have been cases where it takes a couple days for Clarity to be in sync with your bank account.

If you aren’t keeping track of your bank accounts directly, this could lead you to believe you have more or less money than you actually do.

Despite these small caveats, Clarity provides

plenty of options for where to focus your attention in expense tracking. If you

treat the app as an expense tracking tool to enhance rather than coordinate

financial management with, the benefits are great for the average person who doesn’t have time

or care to get into the weeds or be overly meticulous with budgeting.

EveryDollar – For Web and Mobile

Provider: Ramsey Solutions

Cost: Basic – Free; Plus – $10.75/month / $129/year

Are you a shopaholic? Do you struggle staying

organized? Maybe one, or both, of these traits is making it difficult to pay

bills and purchase necessities on a month-to-month basis. Just tracking

expenses won’t keep you in line. You need something to direct your actions: a

budget.

Then again, maybe you’ve already tried this. “It doesn’t work. I can’t stick to it,” you say. You’re not alone. A Gallup poll found only one in three Americans keep a long-term budget.

But with an app like EveryDollar, budgeting can be simplified, even made enjoyable believe it or not, which can put you in that 33 or so percent of Americans who diligently plan their finances. Soon enough, you’ll be kicking bad habits of overspending and be watching your savings grow.

EveryDollar is perfect for anyone new to

budgeting, but it’s also a great tool for the Excel pros who want details. It

provides a templated budget that’s smart enough to remember recurring expenses

and input them for you each month, plus calculate increases or decreases in

savings, investments and debt based on input values. Additionally, you can

tweak the template to include more unique budget items that aren’t already

defaults.

Essentially, EveryDollar takes Excel’s

equations and cells and puts them behind a modern interface that’s easy for

anyone to understand. The beauty of the app is all you have to do is point and

click and enter data inputs.

Moving on from the budgeting feature, what’s

nice about EveryDollar is it’s more than tool–it’s a knowledge base. Developed

by finance guru Dave Ramsey’s namesake company, Ramsey Solutions, EveryDollar

embodies all the best practice from Ramsey’s years of experience in financial

planning and budgeting.

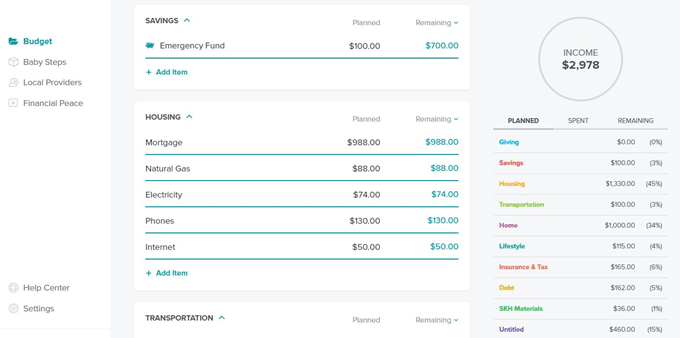

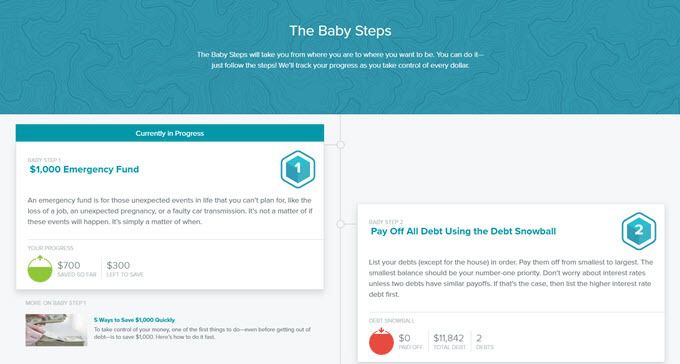

Under the Baby Steps section of the app,

EveryDollar provides a visual, phased journey of goals you can follow, starting

with Baby Step 1, Emergency Fund, and ending with Baby Step 7, Build Wealth and

Give.

Again, the app is smart enough to keep track of where you are on this journey based on what it processes from your budget.

That is, once you reach the savings goal for an emergency fund in Baby Step 1, EveryDollar will automatically move you forward to Baby Step 2, Pay Off All Debt Using the Debt Snowball. Additionally, there are tips included for each step to make your journey towards financial well-being a little easier.

Moving deeper into this idea that EveryDollar

is more than just a budget and also a knowledge base, a third feature offers

tools to help you find local providers for insurance, tax services, retirement

and investing, and buying and selling a home.

What’s great about EveryDollar is the advanced

but intuitive budget feature with the huge plus of being a knowledge base that

guides you towards financial security, rather than just leaving you to figure

things out on your own. So, what’s the downside?

Something as simple as expense tracking ends up costing you extra if you want it. Just to connect your bank accounts and credit cards, as well as receive support, will cost you $10.75 a month, or $129 a year, and not for the depth and breadth of expense tracking you get with Clarity for free.

Then again, boosting your membership to Plus

with EveryDollar could be worth it if you’d rather not keep two apps–one for

expense tracking, one for budgeting–and would prefer to keep everything

centrally located in one very smart and easy-to-understand app.

Mint – For Web and Mobile

Provider: Intuit

Cost: Free

As you delve into the practice of digitally managing finances, you’ll quickly come to understand much of the process is a matter of preference when it comes to how comfortable you are with the robustness, or lack thereof, a tool offers.

But if you’re looking for the ultimate everything-in-one app to manage your budget and expense tracking, it might be difficult to find anything competitive to Mint.

Mint offers everything Clarity and EveryDollar

do in its own flavor, from expense tracking to budgeting to a credit check. In

your overview dashboard, you get a nice display of:

- Accounts

- Bills

- Credit score

- Create budgets

- Goals

- Financial trends

- Investments

- Ways to save

But as with Clarity, there’s a lot to dig into

here. What’s different is Mint is more robust once you start digging. In

general, Mint is insanely more detailed than the two other apps we’ve covered

here, but its makers at Intuit are also conscious of the people who don’t have

time to dig into and understand that level of detail and prefer a higher level

view with some direction.

Here are some examples of features Mint

offers:

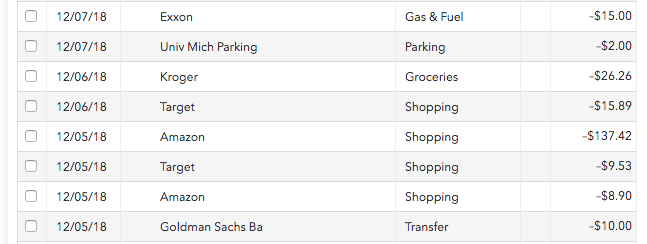

Transactions

The transactions tool is fantastic, as it

emulates what you would see in a banking app, which means you don’t have to

worry about getting used to a different layout or process of scrolling through

expenses. A unique feature here is the ability to tag (i.e., label)

transactions to group them into categories, making them easier to find and

analyze from a higher level.

Bills

Mint gives you a simple overview of bills due

each month as well as cash available, credit available, and payments you’ve

made. A unique feature is a billing cycle calendar that allows you click on dates

to see if/when bills are due as well as add bills you want to be notified of to

pay on specific dates.

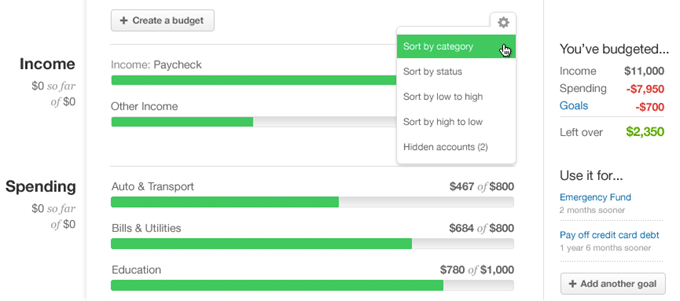

Budgets

While Mint’s budgeting tool is advanced,

EveryDollar’s seems easier to move through and manage. This could be an area

for Mint to improve upon. There’s nothing too complex about the feature, but

the layout and process for managing things aren’t as intuitive as they could

be.

Goals

This is a fun tool comparable to EveryDollar’s

Baby Steps, but perhaps even more robust. The difference is in content. Unlike

EveryDollar, Mint’s feature offers several calculators to help you determine

how to accomplish paying off credit card debt, saving for an emergency, buying

a new car and much, much more.

View

Your Financial Trends

This is where you can generate graphs to

visualize your finances. Unlike Clarity, you have more options for

customization across spending, income, net income, assets, debts and net worth,

which can help you build a better understanding of everything. If it sounds

like a lot, don’t worry, Mint offers suggestions for graphs to try, knowing not

everyone is going to have time to analyze 50 different visuals.

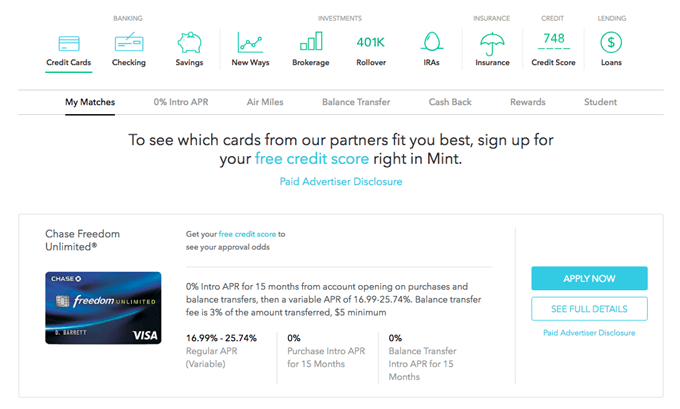

Ways to

Save

Here’s another fun tool Mint offers, giving

you the ability to browse other financial products–credit cards, checking and

saving accounts, 401k rollovers, IRAs and more–to see where you can get the

best bang for your buck. It’s just one more way Mint tries to help you be

smarter with your finances.

But keep in mind, to be as smart as Mint

allows you to be with your finances, you have to be willing to spare the time

and effort.

Conclusion

Clarity is free and gives you the information it believes the average person

needs to ease the process of expense tracking. It takes some getting used to

and some attention, but it can enhance your financial management by centrally

locating all your cash flows.

EveryDollar takes the capabilities of an Excel budget and packages them into an

intuitive and smart interface that hides most of the meticulous work required

to coordinate a budget. But if you want expense tracking, you’ll have to pay

for it.

Mint bundles together the best of budgeting and expense tracking to offer a

breadth and depth of insight to help people at every stage of understanding

their finances. If you truly want the entire package and don’t want to pay a

dime, Mint is a dream come true. But you can’t expect to get much value from it

if you’re not spending a few days a week delving into everything it

offers.

Deciding which app is right for you comes down to preference and understanding what level of guidance you need to help you stay on track.

An app as high-level as Clarity might just tell you what you already know, or an app like Mint might just overwhelm you. Our recommendation is to roll up your sleeves and try each app for yourself. Once you find your fit, you’ll be ready to start managing money smarter in the digital age.