Choice battle roar can be really expensive. Shortly before the European elections in Italy but, it is the Deputy head of the government, but rails against the EU rules and the Italian government bonds slip away.

Italy, as it is formulated in the Roman newspaper “La Repubblica”, was “placed under the special supervision of the markets”. This is probably true. The reaction of financial markets to Statements by the government politicians in Rome, we are currently almost in real time. Deputy head of government Matteo Salvini of the right-wing Lega shoots against the European stability criteria – in the wording: “not a damn to me in the Slightest” – and the cost of Italian government debt are going in the height.

Economy Minister Giovanni Tria asserts, the country would stand to his obligations – and the markets calm down again. The nervousness, however, remains. And you will probably be elections to the Europe, the of 23. to 26. May be held in addition to stop. Especially since the brawlers now together in the government in Rome to sit.

Roller coaster ride

In simple Numbers, the costly roller-coaster ride of Italian government bonds went in this week so far: On Tuesday, the yield on ten-year title, Italy’s rose to a Two and a half-month High of 2.80 percent. Salvini, so the Deputy Prime Minister of Italy, and by many as the home of the head of government of the country acted, had previously said the government in Rome was prepared to ignore the deficit rules of the EU and to push the debt up to 140, which are currently around 130 percent of annual economic output in order to boost the economy.

Quarrels in the Cabinet: Minister of the interior Matteo Salvini and head of the government, Giuseppe Conte (right)

After his Cabinet colleague, Tria, and also as Vice Prime Minister and operating under the name Luigi Di Maio of the “Five star movement” had tried to smooth the waters a bit, the yield on ten-year government bonds on 2,751 percent. Also on Thursday, it remained in there. Behind the Numbers is a serious risk for Italy lies. Therefore, in the Land of the so-called “Spread” – the spread between Italian government bonds and German government bonds, seen sharp. On the Wednesday of the week of the “Spread” grew to about 2.9 percentage points. At a value of 3.5 percentage points, at the time, the then head of government, Berlusconi had lost his office.

Among the major European countries, Italy is the most indebted member of the EU. In the case of 132,2 percent, the debt ratio in 2018 – are allowed according to the EU criteria of 60 percent. A record for Italy: € 2.4 trillion. A large proportion of this debt of the Italian state, the Italian banks hold. More than 400 billion euros in Roman government bonds on their balance sheets, calculating the “Frankfurter Allgemeine Zeitung” now, more than the equity of the entire banking system in the country.

Risk for the banks

Higher costs for the government bonds not to burden only the Italian financial – the high interest rates have to be continuously settled, and limit the scope for other expenditure. You are also weaknesses to the risk for the banks: exchange rate losses of the government bonds the equity capital of the banks, and also you need to fear higher financing costs.

Italy: A Problem Sector Banks

To be able to in the face of these Figures, the nervousness of the markets to assess, may help a look at the wording of the Statements made by the Lega politician Salvini: “It is not only my right but my duty to myself about certain European restrictions to ignore the millions of Italians who suffer from Hunger,” he said on Tuesday the TV station RAI. The rules for the Euro-Zone he described as “obsolete, fiscal constraints, which are imposed on us by the EU”. They are old and of no importance.

Salvini is currently seeking to forge coalitions with other right-wing parties in Europe and explained, the majority in Europe dimensions move in the coming elections to the right.

Positions such as the Salvini’s straining again and again, the European common currency. The Euro fell on Wednesday after the recent Statements of the Lega politician, in the meantime, up to 1,1178 dollars.

Weak Economy

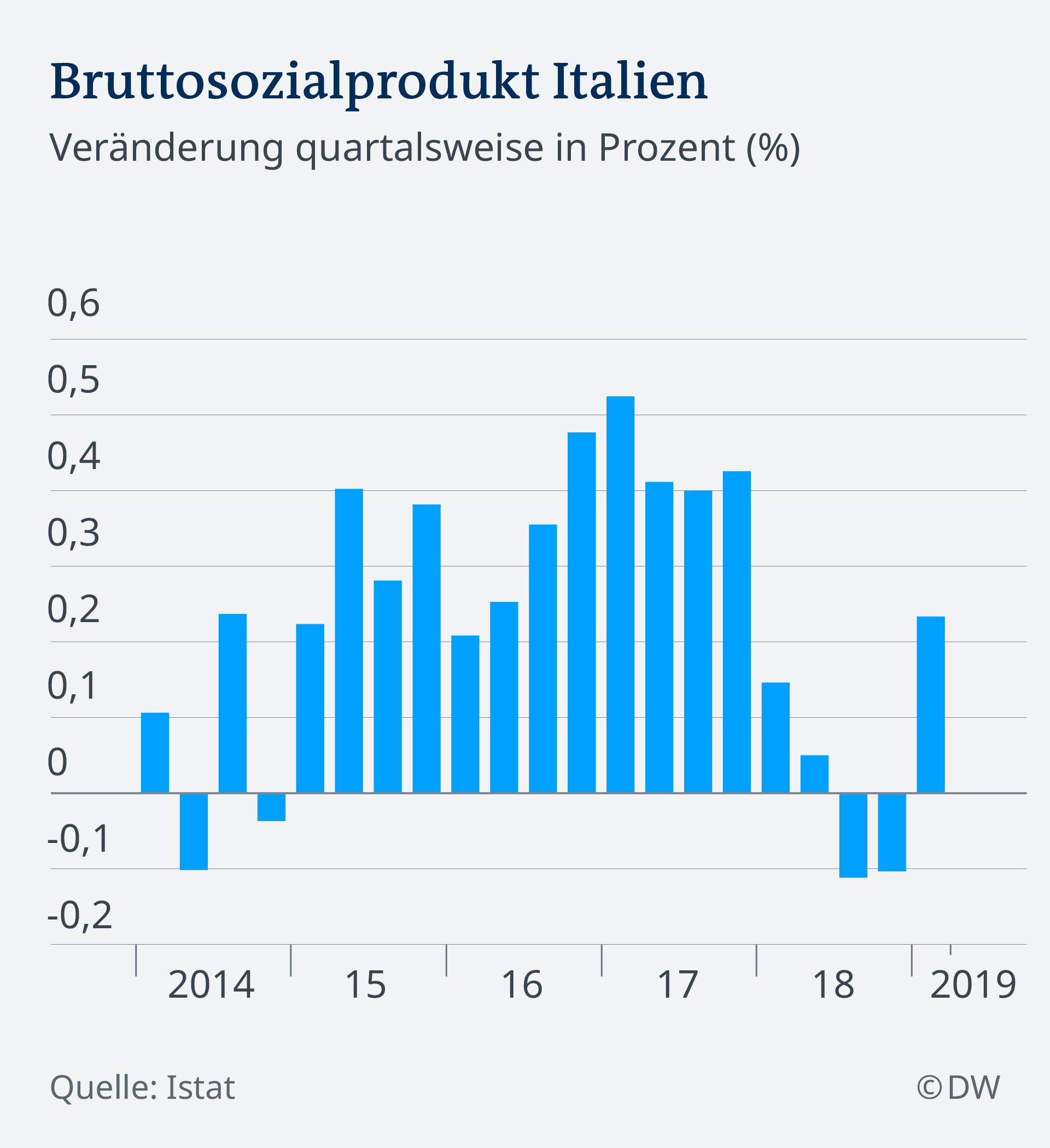

The markets would ignore such Talk during an election campaign, perhaps more likely, if the economy would be situation of the country cause to hope. According to recent estimates by the EU Commission, the government deficit in Italy is set to rise this year to nearly 134 percent of gross domestic product. In the following year, it is likely to be about 135 percent. In contrast, the economic strength declined in the last quarters of last year, and the increase in the first three months of the current year amounted to only 0.2 percent. For the full year, the EU Commission expects growth of 0.1 percent.

Weakening production: Rusted steel plant in Taranto

The unemployment rate in 2018 across the country, at 10.5 percent. Youth unemployment is much higher and exceeds the 30-percent mark. There is concern over the development of the industry: A period of weakness, with a decline in production characterized the last four months of last year. And for the full year of 2018, it brought the production only increased by 0.8 percent – the lowest since 2014. The maue and the trend is continuing: In March, the Italian statistical office, is reported by Istat, a decline in industrial production of 0.9 percent.

The consent of the voters to the party of the strong man of Italy, the Minister of the interior Salvini with his strong spells, seems to have peaked behind. His Lega party came in last polls before the European elections, although average to 31.6 per cent – more than all the other parties, and also significantly more than the coalition partner of the Five-star movement. The “Corriere della Sera” reported, however, from a separate survey, according to which the consent of the Lega was in may, at 30.9 percent. In the previous month, there were 36.9 percent.

ar/hb (rtr, dpa – archive)