Is time-barred, the largest German tax scandal unresolved, because too few investigators are used? Not only in the Cum-and Ex-investigations, investigators, missing the German taxation trade Union warns.

According to research by the West German radio (WDR) and the süddeutsche Zeitung (SZ) the investigators in the Cum-Ex-scandal of the time. Some cases may become time-barred, therefore, before the tax investigation of light into the Dark, the people responsible before the courts and the Treasury – has brought in the best case, around five billion Euro in tax foregone. The reason, WDR and SZ: The state of North Rhine-Westphalia, in the most Cum-Ex-processes in North Rhine-Westphalia are the result of far too few investigators to the elucidation of the largest German tax scandal. The competent NRW ministries reject the allegations. There were not enough investigators, and one could extend the periods of limitation also. Thomas Eigenthaler, Chairman of the German tax Union (DStG), the DW, and with his assessments.

Deutsche Welle: Mr Eigenthaler, press and hold the care for be entitled to the enlightenment of the Cum-Ex-scandal fails?

Thomas Eigenthaler, The things in question here, for many years, and it is complex and many issues. Therefore, it is quite possible that you can’t edit a lot of cases more timely. Besides, it is argued, first, for years the legal situation of the Cum-Ex-transactions, and first of all only as tax loopholes are treated, rather than as cases of tax evasion.

Thomas Eigenthaler, the Federal Chairman of the German tax Union (DSTG)

Another Problem is: Still there is no Cum-Ex-business-a final judgment for tax evasion. There have been closed-only comparisons, because the banks wanted to take no negative reporting in purchasing and would prefer a Deal high sums have been paid to be brought to justice.

How many inspectors it needed to have a case of this magnitude work?

Such Cum-Ex-cases do not happen every day, so we need to get operating with the investigators from the ongoing business. And of course it depends on how many banks are involved, the extent to which the businesses were operated, how many years, and especially the question: is Cooperating with the Bank with the Treasury, or she’s stubborn, sir? All of the things you can’t plan the taxes, but the amount of work to a considerable extent.

As is generally the tax investigation in Germany?

We have in Germany about 4000 tax man and you would have to increase their number because of other cases by about 25 percent, so 1000 new jobs. Those investigators, which were now drawn to the Cum-Ex-investigations, missing elsewhere – such as in a shunting yard. Maybe we can find sometime: Cum-Ex is done. For other things, but still.

Why is there not enough investigators with the tax authorities?

The German financial administration has occupied for many years. Meanwhile, a total of 6000 jobs are missing in Germany. It is difficult for us to find young people on the labour market.

Tax investigators in Germany, currently have a lot of work (archive image)

We complain that the pay is very meager. So financial officers and financial officials are classified at the beginning of their training still like 40 years ago – that can’t be right. Because the requirements are getting bigger, the complexity of cases such as Cum-Ex is huge, and we always have new cases in the Fintech area, so when the new payment methods such as Paypal and Bitcoin. Digitization makes the situation not easier but more difficult.

The Chairman of the Association of German detective, Sebastian Fiedler, speculates that the tight staffing situation in the Cum-and Ex-investigations is wanted by both NRW as well as from the Federal Ministry of Finance. Fiedler speaks of a “political Signal”.

The Federal Ministry of Finance has to do with the Authorities in the countries. There are no guidelines. The countries have used their financial offices over many years as a quarry for savings proposals, and we are paying the price today. In the case of the police to control, in the meantime, but on the other hand, the tax office has, of course, not such a good Lobby. Many citizens say “the fewer The tax office, so much the better.”

The impression prevails, that one looks rather on the erroneous receipts of the “small taxpayers”, the tax offense “to dare the Great”.

Of course you can not put everything only on a case, such as Cum, Ex, and other areas under. There are a good 25 per cent shortage of staff. And, per inspector, one can assume that a tax of about one Million euros. In the case of a company auditor, to take care of the normal operational things, we speak even of an amount of 1,5 million Euro per year. Here, too, we have large deficits in the. Even a normal agent in the IRS, only tax returns, additional taxes of several hundred thousand euros in the year.

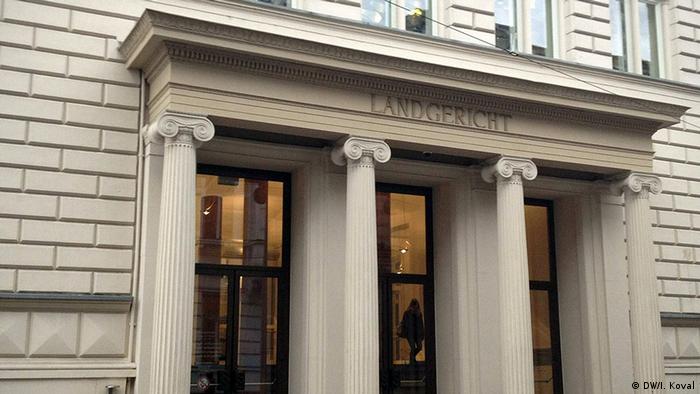

The district court of Bonn would be the most Cum-Ex-proceedings – if the land at all before the court

All of which goes to the state through the cloth. These are extraordinary Numbers, especially when you consider that the salary and the retirement of Finance officer, only a fraction is of what it collects to the tax authorities for tax purposes at more results.

In connection with the Cum-Ex-scandal, insiders say that it is lacking in the tax investigation of the necessary expert knowledge. This is so?

I would contest that. We have no shortage of experts, the legal position is also not convoluted as you might think. However, it is very difficult to determine the facts, the Search is actually a complicated matter. As I said: It is, above all, the staff shortages, which leaves us to our knees. We have the impression that we hunt on bikes, tax evaders, which are in Ferraris on the road. This is not a good feeling. Our people are hardworking and motivated, but we are just too few.

Thomas Eigenthaler Federal Chairman of the German tax Union (DStG). Before the 60 headed-Year-old, the tax office in Stuttgart.

The Interview was led by Jeannette Cwienk.