Greece is leaving this Monday the EU rescue umbrella. How has the economy since the start of the austerity programme? And the country can reach its fiscal targets? A data analysis provides the answers.

Greece’s public debts are twice as high as the EU average, the economic performance has declined since the beginning of the crisis to one-third, and one out of every five people is unemployed: At first glance, the Situation offers no cause for optimism.

Traditionally, the service sector has the largest share of Greece’s gross domestic product (GDP), followed by industry and agriculture. But Greece is not in urgent need of new sources of income, so that it slips back into recession, now that the third aid program is terminated.

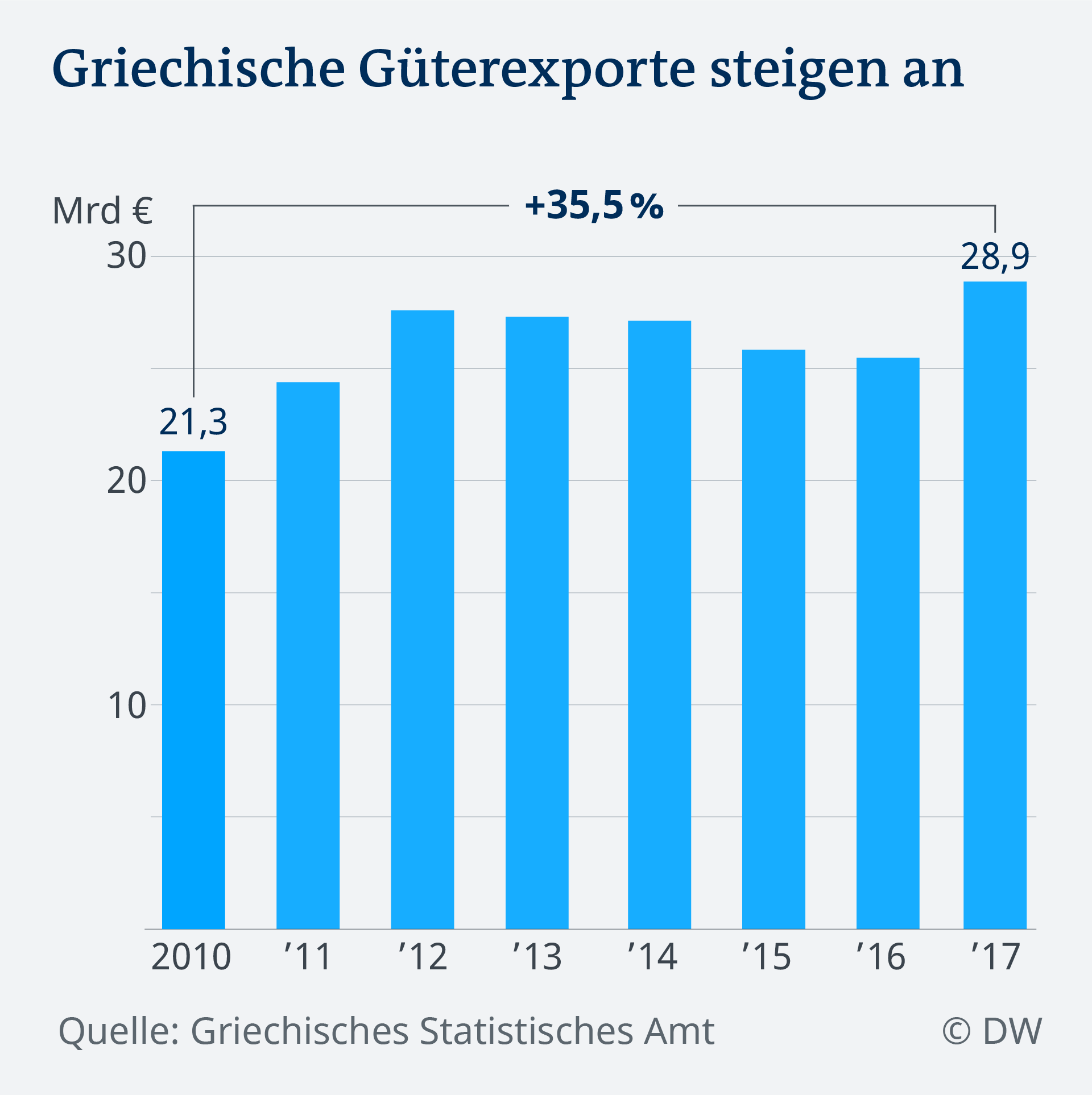

The country hopes to strengthen the export economy. In spite of the economically difficult years, the exports of goods and services between 2010 and 2017 have increased by 35.5 percent, which resulted in Athens and Brussels for relief.

Among the most important export partners of Greece, Italy, Germany, Cyprus, Turkey and Bulgaria.

The question is whether this development is sustainable and strong enough remains, so that the country can again stand on their own feet. To answer this question, has evaluated the DW economic data from 2010 to 2018. The analysis shows that there are some reservations.

Title 1: labour costs have fallen during the crisis

At the beginning of the crisis in 2010, the cost of labour at the highest level for ten years. Then they fell strongly: “fiscal restructuring in the context of the EU stability programme, the labour costs are significantly reduced,” says George Pagoulatos, Professor of European politics and economy at the University of Economics in Athens.

Greek exports benefited from rapidly falling labour costs, which have declined since 2010, more than 30 percent, and in 2017, only slightly recovered.

Actually, it is an advantage for Greek exporters, if you need to pay less for a well-educated workforce. But there is a downside: labour costs include both wage costs as well as taxes and duties. Wages fell during the crisis, more than the total labour costs.

“However, the competitive advantage of lower wages partly eaten up by higher costs for taxes, social charges, energy, and loans,” says Pagoulatos. Thousands of companies had to either close it or have relocated their offices in countries with a lower tax burden. This has weakened the economy further.

“Now, it is important that the productivity gains, so that wages can rise again,” says Pagoulatos. Because without higher productivity of Greek companies have on the world market, no Chance.

Title 2: exports are mainly driven by a sector

The second Reservation is the low diversity of exports. Comparing sectors, the export volume of various economic, stands out as a sector: it is Not olive oil or sheep’s cheese, but refined petroleum and other minerals make up a third of the Greek goods exports in the first five months in 2018 and to exceed all other sectors.

Contrary to the General perception of industrial goods have a larger share of Greek exports and are growing faster than agricultural products (food and livestock).

Experts such as Christina Sakellaridis, President of the pan-Hellenic Export Association, will see exports of petroleum products skeptical: “The price of oil fluctuates, we are not able to influence it. If the price of Oil rises strongly, this will affect the cost of domestic production in Greece and thus the competitiveness of Greek products on the international market.”

Greece would be therefore well-advised to make its exports more versatile. “Lately, we see an increase in exports of new technologies and products, the knowledge in highly specialized technical expertise and Innovation,” said Sakellaridis. “For us, this is a very encouraging development.”

Reserved 3: Greece there is a lack of strong export wholesale company

Greece was, in fact, a major manufacturer of industrial products, says Konstantinos IUI mos, Vice-Chairman of the Hellenic entrepreneurs Association. The country has one of the highest shares of Small and Medium-sized enterprises (SMEs) in the European Union. Because there is but little to big companies, and not the country, to be able “to compete on the international market”.

This leads to the third Caveat: SMEs able to enter into the export business as larger companies. “In Greece, small firms are only half as productive as in the EU average,” says IUI mos. “Their participation in international value chains is also low.”

Add to that the difficult financing situation. During the crisis, companies had little access to credit. At the same time, banks will see a part of the lent money with a high probability of never: The volume of so-called non-performing loans has increased ten-fold, from eleven billion Euro in 2008 to 110 billion euros at the peak. Today, it is located at 94 billion euros. Greek banks are still not able to business financing to offer. Greek companies, especially small and medium-sized, have to grow, therefore, difficulties and their export business.

IUI mos refers to the non-performing loans as “a lasting legacy of the crisis” and warns that it “can bring any growth opportunities to Fail”.

Too big of a challenge?

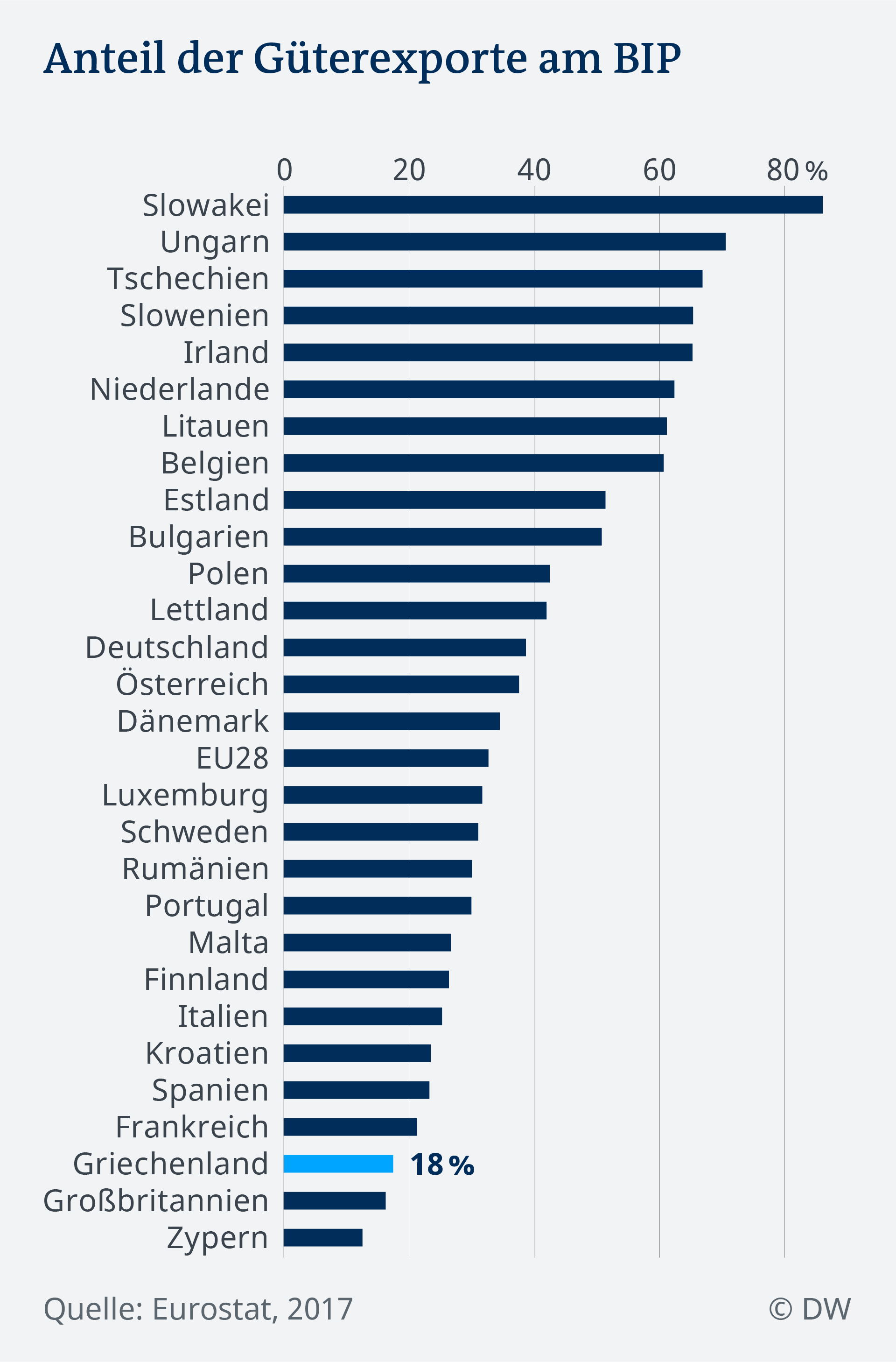

Although the Greek exports rise, they contribute relatively little to economic output. Greece is in the EU at the bottom end, only slightly ahead of the UK and Cyprus, who have specialised in the Export of services rather than on goods exports.

Greece’s goods exports account for 18 percent of the country’s GDP, far less than the EU average of 33 percent. Other crisis-stricken countries such as Portugal (30 percent) and Ireland (66 per cent) are better off.

Greece is chronically dependent on imports. The state must compensate lend regularly money in the financial markets, its negative trade balance – the difference between Import and Export. After all, services such as tourism and shipping can alleviate the massive deficit in the goods sector. Lately, the trade deficit has become smaller, because the Greeks have less imports and more exports.

Overall, Greece would have the capacity to be a solid export nation. However, structural problems hinder the economic recovery process: likely to be rising labor costs, lack of diversity of exports, the lack of large-scale enterprises, the lack of financing options and a non-existent national export strategy.

Nevertheless, Greece appears to be on the right path. It must meet strict targets for primary budget surplus – a measure of the government finances, the loan repayments excludes: 3.5 percent of GDP by 2023, and 2.2 percent by 2060, an ambitious undertaking. For the current year, the Greek government expects a primary surplus of 3.8 percent of GDP.