The G20 is to promote private investment in Africa and to create employment. China goes ahead with massive infrastructure investments in southern Africa for years. It is a model for the “Compact”?

Especially the German economy is holding back so far, it is only represented with about 1000 companies on the African continent and is ranked as an Investor in an international comparison, “also-RANS”. Stefan Liebing, the Africa-Association of the German economy holds a stronger national commitment is essential, in order for the changes: “Just cautious family company from the German middle class will not go alone to Africa, because in many cases, the risks are still too great. Therefore, we need a new Form of risk-sharing between public and private, as the practice of our competitors in Asia already for a long time.”

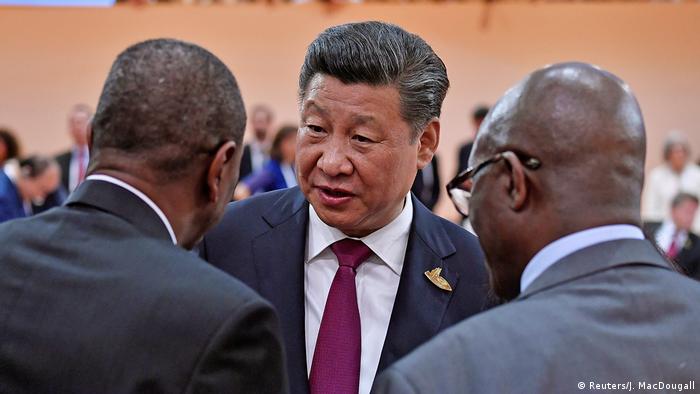

Competitors from Asia: This is meant primarily China, for at least ten years of increasingly important Player in Africa, and who alone is made in 2016, more than double the number of new direct investments in Africa, such as the United States. China is, according to a recent study by the consulting firm McKinsey, with around 10,000 companies present in Africa, other estimates against even a multiple of this number. The are not only state-owned enterprises, but medium-sized farms, and also “a large number of small entrepreneurs who believe in Africa”, such as the International monetary Fund (IMF) in a recent study writes.

China’s infrastructure project in Mali

China’s diverse economic activities in Africa

And it is only the model infrastructure (e.g. copper against railway lines), which followed China in Africa, such as Robert Kappel from the Hamburg-based GIGA Institute for African studies, explains in a DW interview was a long time ago. “Today there is a much greater diversification of Chinese investments made in all sorts of areas, for example, hotel construction, tourism, food industry, agricultural production, processing industry, where local products are further processed, and metal production, repair operations, quite apart from trade.”

Variety of industry sectors and diversity of company size, are characterized, therefore, China’s activities in Africa. But, above all, a third thing that makes the difference to foreign competition, such as Robert Kappel says, namely, the long-term strategic Thinking. “Many Western companies can’t have such long-term strategies, because they are annually evaluated according to whether they make a profit. If you make no profits, you may be out of the business.” And therefore, China had become, with its state-owned enterprises and the many Thousands of small and medium-sized enterprises in Africa, so strong.

Stefan Liebing from the Africa Association of German business

Advantage through government backing

It is the state of the back cover is able to build on the China companies, which has been lacking so far on the German side, as Stefan Liebing of Africa-the Association criticized. Chinese companies are “very, very good, complete solution packages with the help of state funding.” Therefore, the promotion of the German economy should be “as a self-evident Element of the development co-operation” treated – the same way as do the Chinese.

It is true that Germany do a lot of things different than China, right, Liebing, “however, we can also learn from the Chinese.” Much more money than the estimated $ 1.6 billion in development aid from give to China for trade promotion and government loans and consider this also as a development cooperation in the broad sense. “If the Federal government wants to embark on a similar path, and even China cooperate, it can only be of advantage for the development of the African continent and for the German economy.”

China’s silk road Initiative OBOR

So far, no “job miracle” by China’s investment

But what is the Chinese success as an Investor in Africa means for the creation of jobs? For this purpose, Robert Kappel: “small and medium-sized companies, especially the African market and also create employment. Often there are also Chinese, the family that is taken. But there are also local jobs are created by Chinese.”

Stefan Liebing, the Africa-Association is more skeptical, and provides a comparison: “The almost 1000 German companies invest in Africa, workers at least 200,000 workers directly. In a year, 20 million jobs will be needed in addition to the is yet, of course, only a drop in the bucket,” admits Liebing. China have, however, created in the comparison to Germany in the last few years, with its twelve billion dollars in investment and 40,000 businesses but only around 48,000 jobs.

Dr. Robert Kappel from the Hamburg-based GIGA Institute

The reason for this is that the Chinese are investing in the raw materials sector, in the construction industry and also in the financial sector, where not necessarily jobs. China is investing in the processing industry, such as, for example, in Shoe factories. The individual small industry but “zones”, where China also creates jobs. “But they are often paid very poorly and do not meet international Standards”, noted the spokesman of the German economy in Africa is critical.

Cooperation with China – but how?

Both Africa experts, industry representatives and the scientists, to see fields of cooperation between Germany and China in the implementation of the “Compact”. However, different: Liebing, mainly with a view to greater opportunities for German participation in infrastructure projects. Kappel says that you have to together with China to complement the Compact by “employment measures”. Here is a weak point of the paper to the G20″, it does not go should only large infrastructure projects”. “The local governments need to provide a System of support and investment incentives, linking the local industry with large investments from abroad.”

China’s state-owned company CRCC in Benguela/Angola

Also, the IMF writes of a “permanent challenge” in connection with foreign direct investment in Africa. It is a suitable policy framework would need to be created so that these investments achieve the maximum Benefit. You would have to for the benefit of the local industrial capacity, so that countries are well prepared against the next crash of commodity prices.