South America

Argentina offers billion in Schuldenstreit

In the long deadlock in the Schuldenstreit between Argentina and several US hedge funds is on the move. The new President Macri offers a milliarenschwere repayment. Still are but not all of the hurdles.

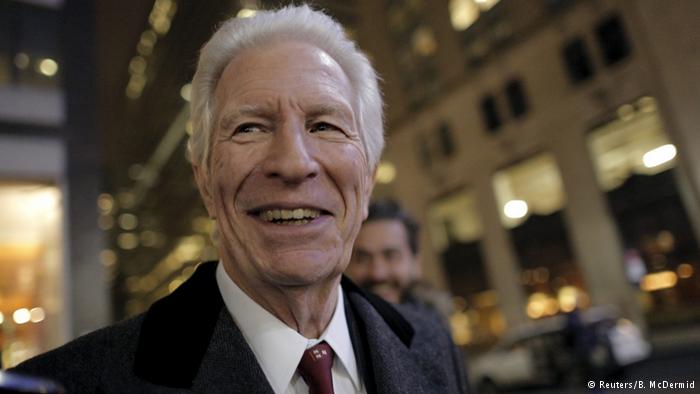

As the Argentine government in Buenos Aires and the US mediator Daniel Pollack (see the article) told, wants to be President Mauricio Macri for a refund in the amount of 6.5 billion dollars (5.8 billion euros) offer. Total denies Argentina with the hedge funds to outstanding debt in the amount of about nine billion dollars.

The editorial recommends

Argentina’s Peso crashes

The Argentine currency Peso compared to the U.S. Dollar considerably lost value. The crash was expected, after the government on Wednesday, the capital controls had reversed. (17.12.2015)

Argentina’s new President Macri abolishes taxes

Argentina’s new President Mauricio Macri wasted no time. Shortly after his taking office, he announced reforms in force. (15.12.2015)

Argentina hopes for an economic miracle

Before its official took office, President Mauricio Macri characters: With a Cabinet of bankers and managers he wants to, after twelve years of foreclosure in the country to a free market economy to come back. (07.12.2015)

According to the now agreement, according to the government, so far two hedge funds have agreed to take the creditors a haircut of about 25 percent. A prerequisite is, according to US mediator Pollack said that the Argentine Parliament agrees and the arrangement of a New York court will be repealed.

Since 15 years of debate

The background is a dispute with the two US hedge funds NML Capital and Aurelius. These had after of bankruptcy at the end of 2001 Argentine bonds cheaply acquired and required then the nominal value of the bonds. The US Federal judge Thomas Griesa had later decided that Argentina only the two hedge funds $ 1.3 billion to pay off had before it the claims of other private sector creditors to settle the deal.

The previous government of President Cristina Kirchner had this but strictly denied. The sum will not be paid, the hedge funds were “Geierfonds” had the Argentine Ex-President explained. Unlike the petitioning U.S. hedge funds had about 90 per cent of the creditors of Argentina in the years 2005 and 2010, a debt restructuring agreed and up to 70 percent of their money is dispensed.

haz/ago (rtr, dpa, afp)